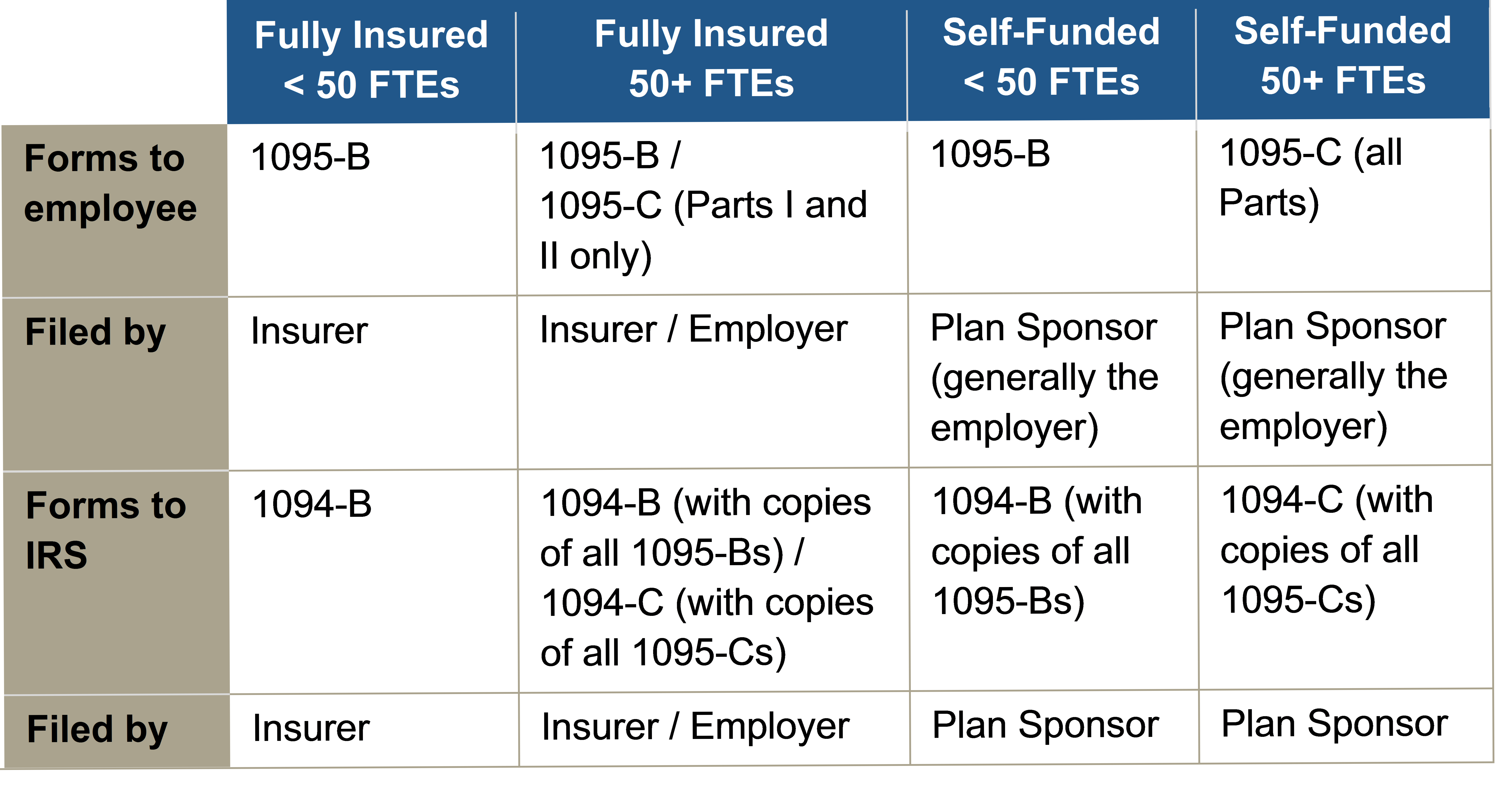

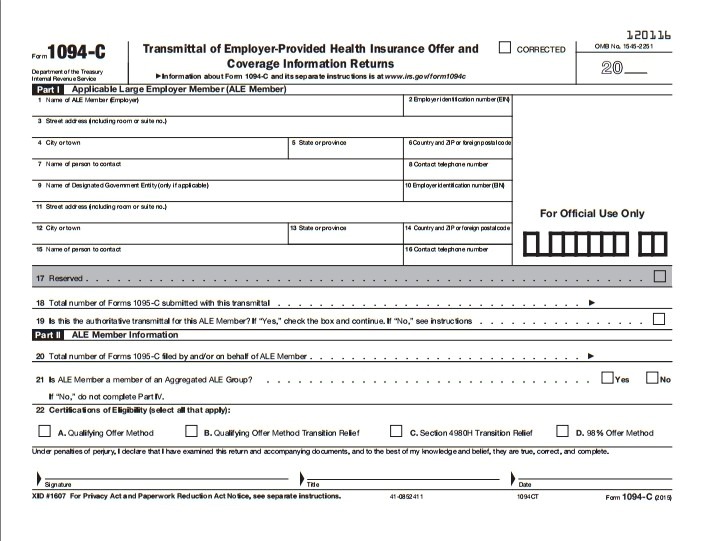

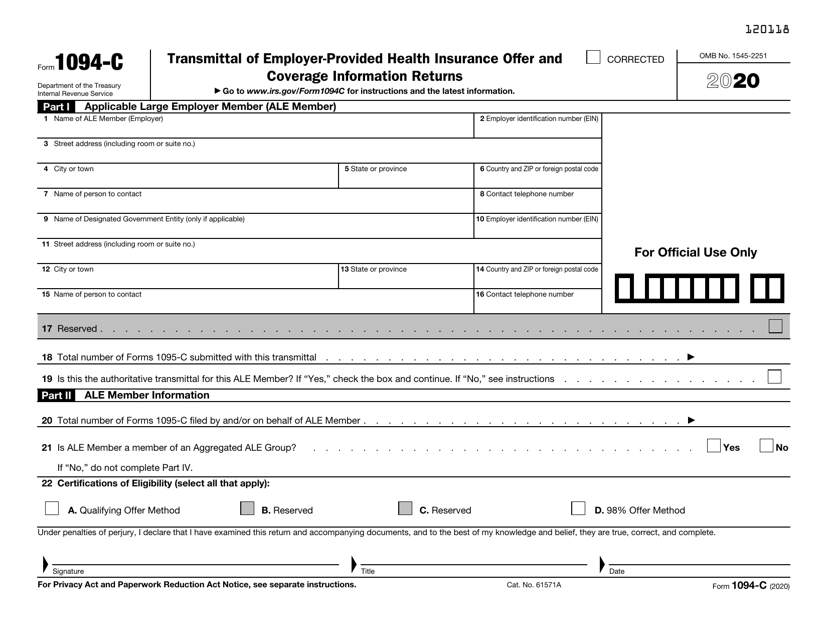

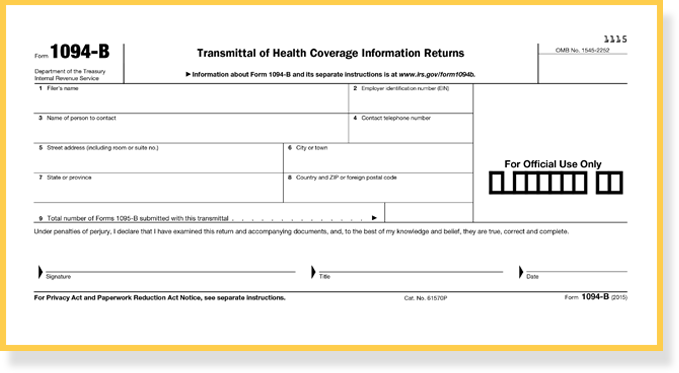

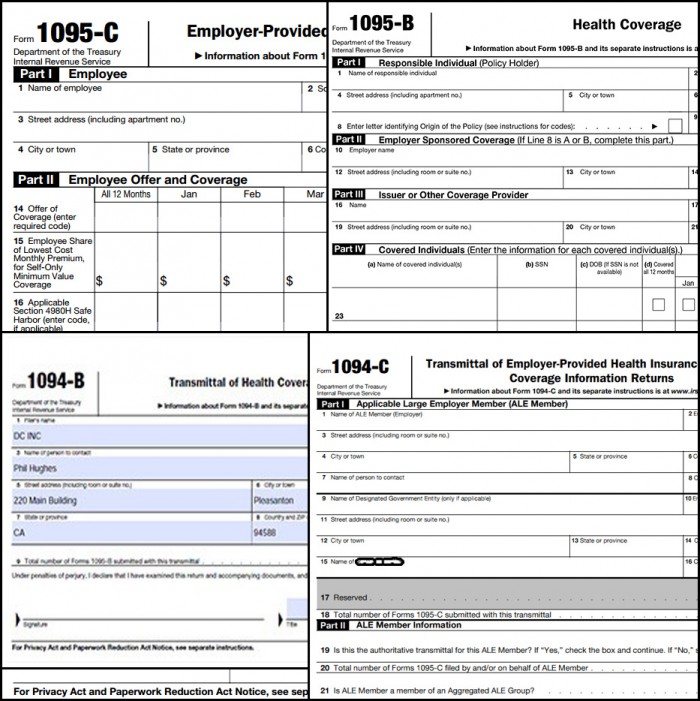

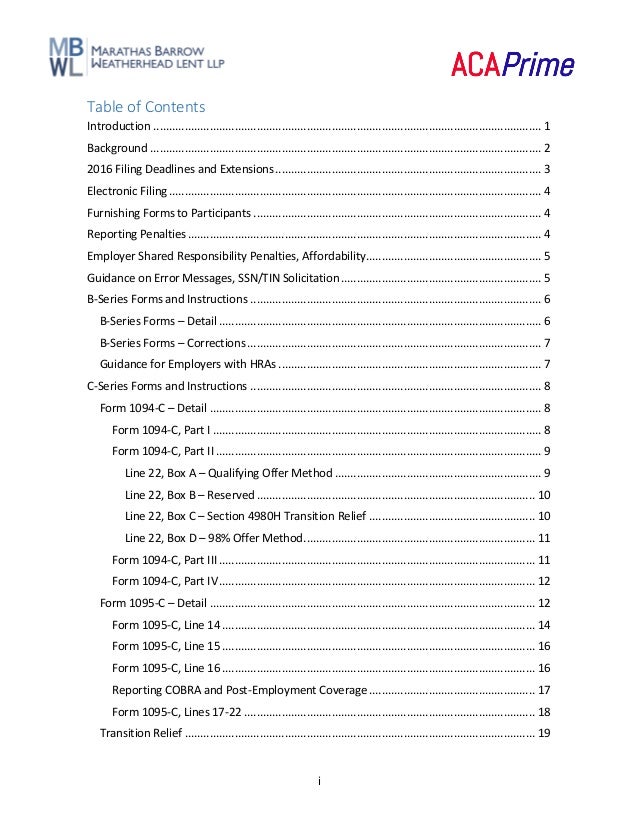

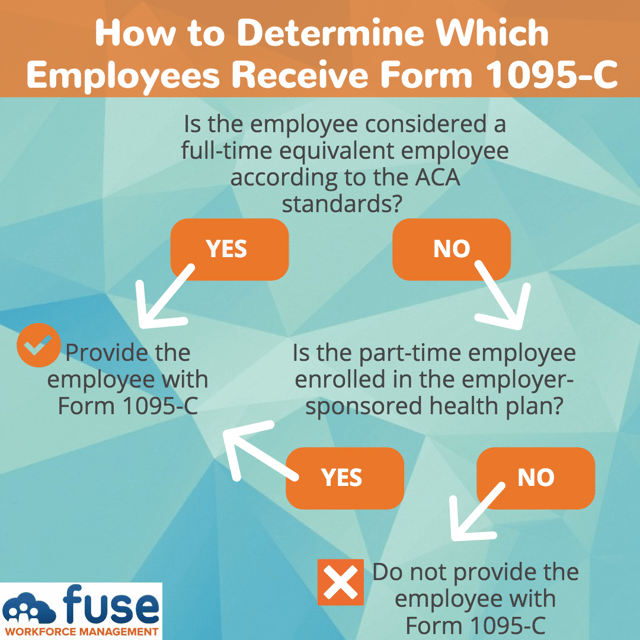

The IRS has released final Forms 1094/1095B (B Forms) and Forms 1094/1095C (C Forms), and related instructions, for the 19 tax year No material changes have been made to the forms, either from prior years or from the drafts released in November (see our Checkpoint article) (The "Instructions for Recipient" included with Form 1095B and 1095C have beenNote that substitute forms may be used, but the substitute forms must include all of the information required by Forms 1094C and 1095C and must satisfy all of the IRS's form and content requirements Forms 1094B and 1095B are to be used by a small selfinsured employer that is not an ALE for Section 6055 purposes All applicable large employers (ALE) must file Forms 1094C and 1095C with the IRS and furnish a copy of the 1095C to all fulltime employees The insurance carrier for a fully insured plan must complete Forms 1094B and 1095B Generally, only employers that are nonALEs with a selfinsured plan will complete Forms 1094B and 1095B

Wnj Com

1094 c instructions 2019

1094 c instructions 2019-Instructions for 18 Forms 1094C and 1095C Additionally, the IRS maintains a helpful Information Center webpage with resources and tips for applicable large employers about the information reporting requirements and other topics IRS Forms 1094C and 1095C are filed by employers that are required to offer health insurance coverage to their employees under the Affordable Care Act, also known as Obamacare The main difference between them is that the 1095C provides information about health insurance and is sent to both employees and the IRS, while the 1094C acts as a cover

Streamlined Aca Reporting Methods Newfront Insurance And Financial Services

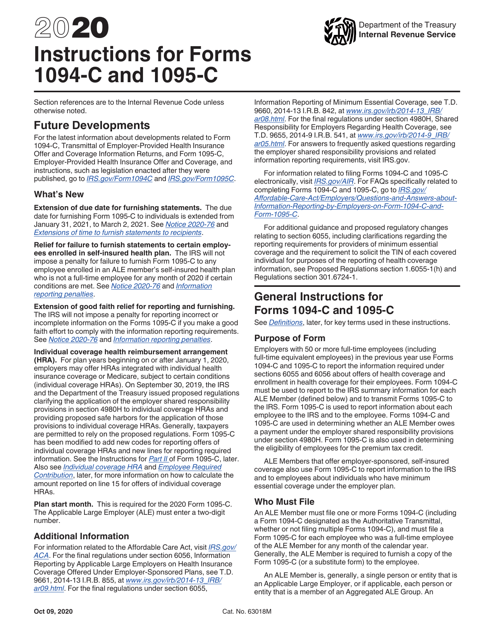

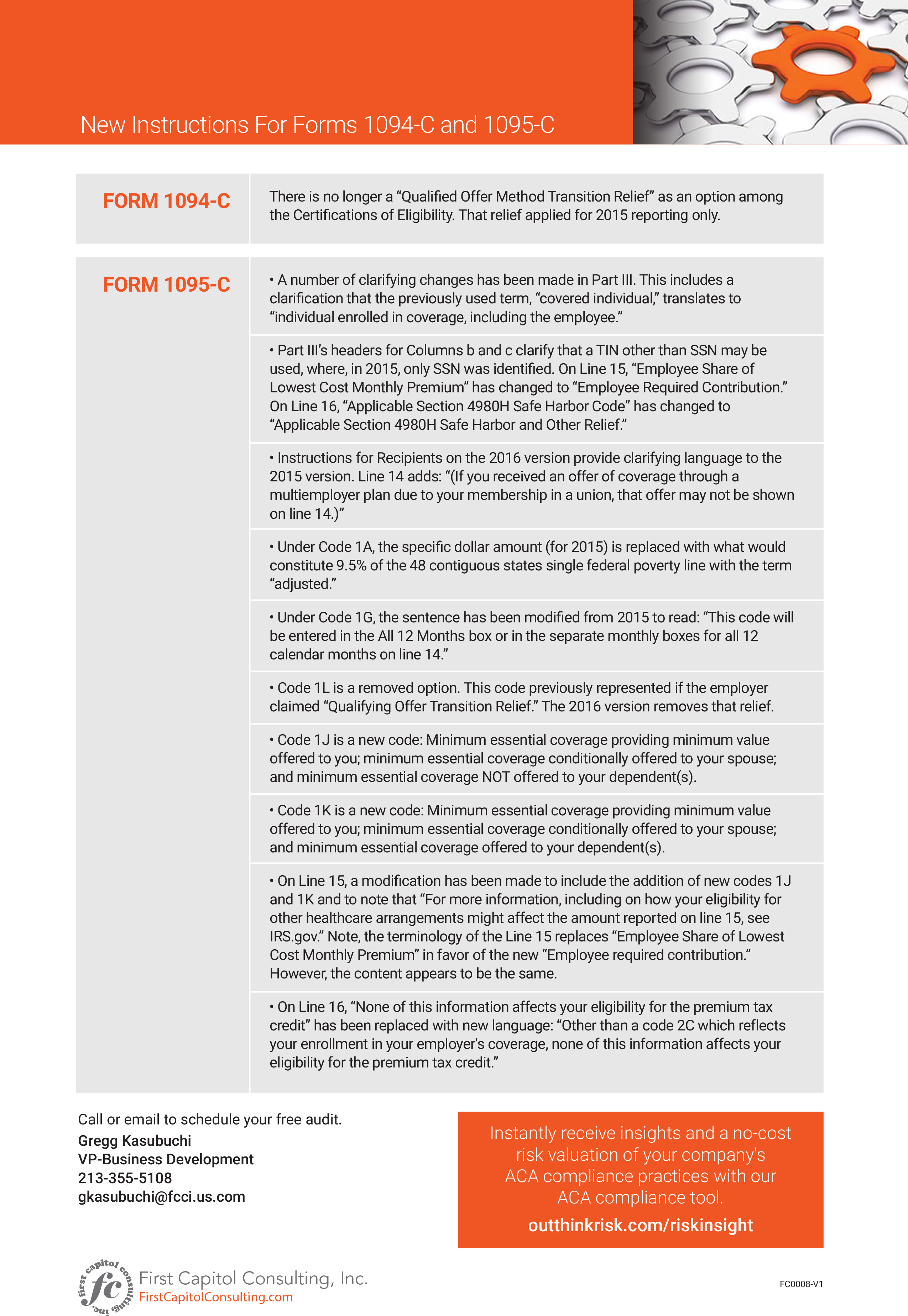

On the IRS finally released its draft instructions for the Forms 1094C and 1095C While we knew substantial changes were coming to the instructions as a result of Individual Coverage HRAs (ICHRAs), the IRS also made changes that will impact every employer required to file the Forms As a result of most employers not offering ICHRAs and forHowever, it is still possible that changes will occur HR managers will usually accept forms from the previous year There are, however, some 1094C and 1095C form changes that need to be understood Verbiage Change to the Form Instructions Forms 1094C and 1095C have both experienced verbiage changesIRS Issues Draft ACA Reporting Instructions for 21 Joanna KimBrunetti The IRS recently released its draft 1094C and 1095C instructions for the 21 tax year We've identified the changes below It appears that Form 1094C will remain the same, but Read More

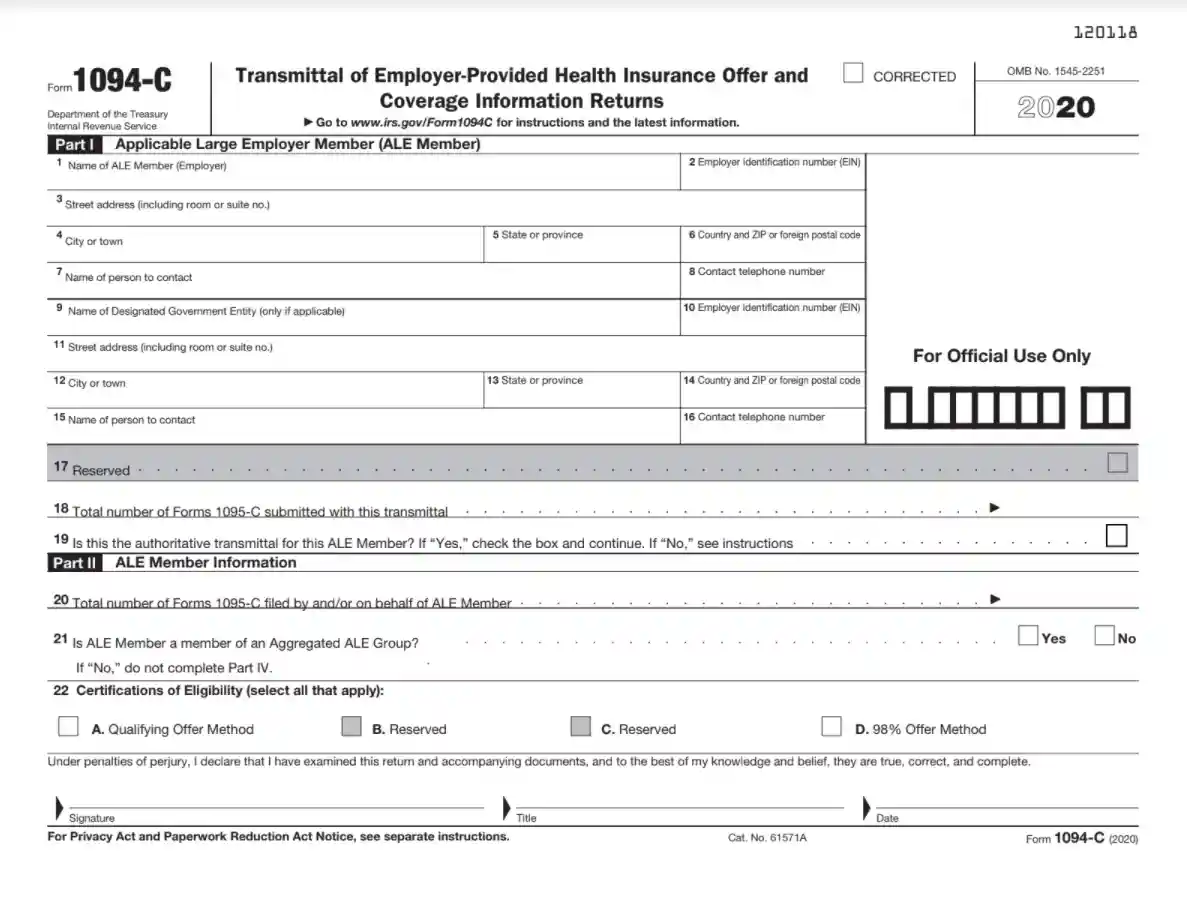

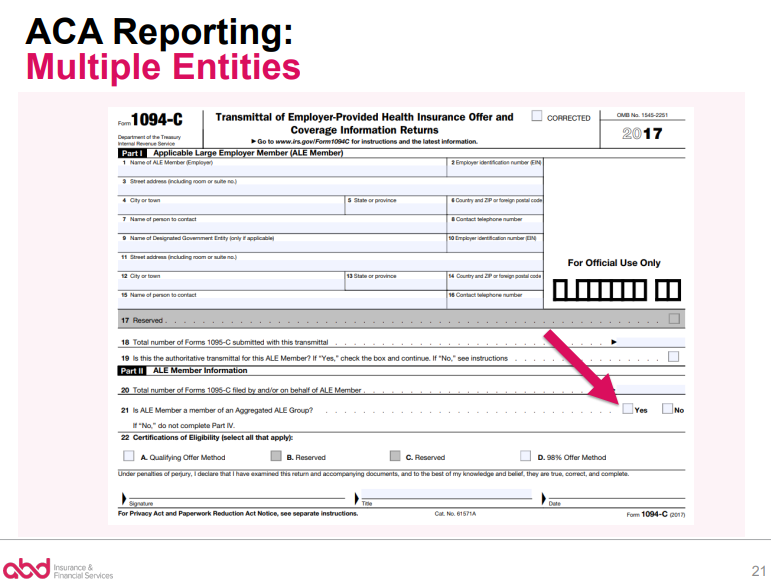

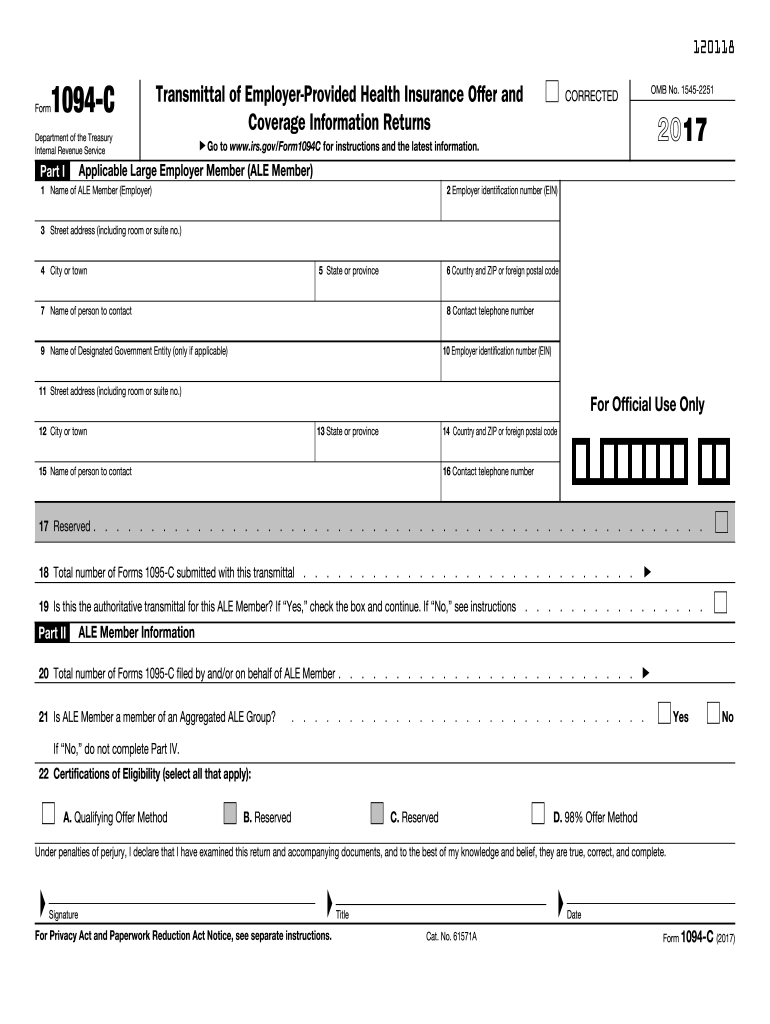

In the case of a Governmental Unit that has delegated its reporting responsibilities for some of its employees, the Governmental Unit must ensure that among the multiple Forms 1094C filed by or on behalf of the Governmental Unit transmitting Forms 1095C for the Governmental Unit's employees, one of the filed Forms 1094C is designated as the Authoritative Transmittal andAll Applicable Large Employer (ALE) Members are required to file Forms 1094C and 1095C for Coverage Years starting in 16 Health coverage provided by a selfinsured large employer (an "applicable large employer" or ALE over 50 employees) is reported on Form 1095C The report is filed with the IRS on or before February 28 if filing on paper (or March 31 if filing electronically)Employers will file copies of Forms 1095C with transmittal Form 1094 C to the IRS The employer will indicate on Form 1094 C if it is eligible for alternative (simplified) reporting Employers also will use this form to certify that the employer is eligible for transition relief under the ACA "play or pay" rules, if applicable

Back to 1094C Form Guide ;If you are filing Form 1094C, a valid EIN is required at the time it is filed If a valid EIN is not provided, Form 1094C will not be processed If you do not have an EIN, you may apply for one online Go to IRSgov/EIN You may also apply by faxing or mailing Form SS4 to the IRS See the Instructions for Form SS4 and Pub 1635 Parts II, III, and IV of federal Form 1094C is not required If you completed this section of the form for IRS purposes the FTB will disregard this information The same federal Form 1094C submitted to the IRS can be submitted to the FTB Get the instructions for federal Forms 1094C and 1095C for more information Specific Instructions for

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Aca Forms 1094 C And 1095 C And Reporting Instructions For The Aca Times

1095C C Form Instructions The IRS has released final Forms 1094C and 1095C (C Forms) and final instructions for the C Forms for the 17 tax year (Final Forms 1094/1095B, but not the instructions, have also been released We'll cover those items in a separate article after the final instructions become available)If there is only one 1094C being filed for an employer's 1095C forms, that form is identified on Line 19 as the Authoritative Transmittal If multiple 1094C Forms are required to file an employer group's 1095C Forms, one of the Forms 1094C must assume Authoritative Transmittal in Line 19 and report aggregate employerlevel dataBack to 1094C Form Guide ;

trix Irs Forms 1094 C

Irs Releases Final 18 Forms 1094 And 1095 And Related Instructions And Publications

Final instructions for both the 1094B and 1095B and the 1094C and 1095C were released in September 15, as were the final forms for 1094B, 1095B, 1094C, and 1095C Form 1094C It is often referred to as the "transmittal form" or "cover sheet" The IRS has released the final versions of the ACA reporting Forms 1094C and 1095C, in addition to the reporting instructions for the tax year, to be filed and furnished by Applicable Large Employers (ALEs) in 21 You can find the1094C and 1095C to report the information required under sections 6055 and 6056 about offers of health coverage and enrollment in health coverage for their employees Form 1094C must be used to report to the IRS summary information for each ALE Member (defined below) and to transmit Forms 1095C to the IRS

Wnj Com

Irs Is Sending Aca Penalty Notices To Employers Lexology

Forms 1094C and 1095C are filed by applicable large employers (ALEs) to provide information that the IRS needs to administer employer shared responsibility penalties and eligibility for premium tax credits, as required under Code § 6056 The IRS has just released instructions and draft Form 1094C and 1095C for 19 Employers with 50 or more fulltime employees (including fulltime equivalent employees) in the previous year use Forms 1094C and 1095C to report the information required under sections 6055 and 6056 about offers of health coverage and enrollment in health Information about Form 1094C, Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns, including recent updates, related forms, and instructions on how to file Form 1094C is the transmittal form that must be filed with the Form 1095C

Draft Instructions For Aca Reporting Forms Ubf

Irs Releases Final 18 Aca Reporting Forms And Instructions Health E Fx

The Internal Revenue Service (IRS) recently released the 1094C / 1095C forms and instructions to be used by Applicable Large Employers (ALEs) for the 18 tax year reporting required by the Affordable Care Act (ACA) ALEs sponsoring a selffunded health plan may use Part III of Form 1095C to provide individual coverage information to plan participants in lieu ofBack to 1094C Form Guide ;1094C Department of the Treasury Internal Revenue Service Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns Go to wwwirsgov/Form1094C for instructions and the latest information OMB No 18 Part I Applicable Large Employer Member (ALE Member) 1 Name of ALE Member (Employer) 2

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

The Instructions For Forms 1094 C And 1095 C Blog Taxbandits

Inst 1094C and 1095C Instructions for Forms 1094C and 1095C Form 1095A Health Insurance Marketplace Statement 21 Inst 1095A Instructions for Form 1095A, Health Insurance Marketplace Statement Form 1095B Health CoverageFile a Form 1094C Transmittal (DO NOT mark the CORRECTED checkbox on the Form 1094C) with corrected Form(s) 1095C Furnish the employee a copy of the corrected Form 1095C, unless the employer is eligible to use the Qualifying Offer Method orPart III ALE Member Information Monthly Line 23 to Line 25 ALE Member Information Reminder Part III (Lines 2335) should only be completed on the Authoritative Transmittal for the employer In Column (a), if you offered Minimum Essential Covertage (MEC) to at least 95% of your fulltime employees and their dependents, enter "X" in

Affordable Care Act Lessons Learned Ppt Download

Filing Form 1094 C Youtube

Reporting forms, aka Forms 1094 and 1095 and instructions Applicable Large Employers ("ALEs")¹ are obligated to issue and file the 18 AA information returns Other than some formatting modifications, there are no significant changes from the 17 forms and instructions As a reminder, the A A individual mandate penalty for 18Part II ALE Member Information Line Total number of Forms 1095C filed on behalf of ALE Member In Line , enter the the total number of 1095C Forms that will be filed by the employer This includes 1095C Forms accompanying this Form 1094C, as well as any other 1095C Forms filed with different 1094C Forms under the same employer IRS Releases Final 1094C and 1095C Forms and Instructions On , the Internal Revenue Service (IRS) released the final Forms 1094C and 1095C that are required to comply with section 6055 and 6056 of the Affordable Care Act (ACA) Employers that are subject to the employer shared responsibility provisions under section 4980H

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Streamlined Aca Reporting Methods Newfront Insurance And Financial Services

The deadlines for filing Form 1095C with the IRS and furnishing copies to the recipient are as follows , is the deadline to distribute recipient copies , is the deadline to paper file Forms 1095C with the IRS , is1094C and 1095C to report the information required under sections 6055 and 6056 about offers of health coverage and enrollment in health coverage for their employees Form 1094C must be used to report to the IRS summary information for each ALE Member (defined below) and to transmit Forms 1095C to the IRS1094C and 1095C to report the information required under sections 6055 and 6056 about offers of health coverage and enrollment in health coverage for their employees Form 1094C must be used to report to the IRS summary information for each employer and to transmit Forms 1095C to the IRS Form 1095C is used to report information about each employee In addition, Forms

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

Understanding Part Ii And Part Iii For Form 1094 C 15 Boomtax Knowledge Base

1094C and 1095C to report the information required under sections 6055 and 6056 about offers of health coverage and enrollment in health coverage for their employees Form 1094C must be used to report to the IRS summary information for each ALE Member and to transmit Forms 1095C to the IRS FormInstructions Tips More Information Enter a term in the Find Box Select a category (column heading) in the drop down Click Find Click on the product number in each row to view/download Click on column heading to sort the list You may be able to enter information on forms before saving or printingUnderstanding Part II and Part III for Form 1094C (16) Part II 22a Qualifying Offer Method To be eligible to use the Qualifying Offer Method for reporting, the employer must certify that it made a Qualifying Offer to one or more of its fulltime employees for all months during the year in which the employee was a fulltime employee for whom an employer shared responsibility payment

Irs Releases Draft Forms And Instructions For 18 Aca Reporting Brinson Benefits Employee Benefits Advisory And Patient Advocacy Firm

Form 1094 Instructions Employers Need For The Aca Reporting Deadline

IRS ISSUES ACA 18 FORMS 1094C AND 1095C, INSTRUCTIONS, AND 226J FOR 16 Robert Sheen ACA Reporting, Affordable Care Act 1 minute read The IRS has released the final 1094/1095C schedules and reporting instructions for the 18 tax year, to be filed and furnished in 19 You can find the 18 instructions at this linkForm 1094C is a coversheet that must accompany every Form 1095C a reporting employer sends to the IRS 36 37 If you find yourself sending a Form 1094C, without attaching Forms 1095C, to the IRS, you are doing it wrong 37 38 Also, ensure you have the right form for the right yearPart I Applicable Large Employer Member (ALE Member) Line 9 Name of designated Government Entity (only if applicable) In Line 9, Begin with the complete name of DGE If you are a DGE filing on behalf of an ALE, use Lines 916 to enter the DGE information

1094 C 1095 C Software 599 1095 C Software

2

Instructions for Forms 1094B and 1095B 21 Inst 1094C and 1095C Instructions for Forms 1094C and 1095C 21 Inst 1095A Instructions for Form 1095A, Health Insurance Marketplace Statement 21 Form 1095A Health Insurance Marketplace StatementInstructions Tips More Information Enter a term in the Find Box Select a category (columnInst 1094C and 1095C Instructions for Forms 1094C and 1095C 14 Form 1094C

trix Affordable Care Act Aca Forms

2

Instructions for Forms 1094C and 1095C 16 Inst 1094C and 1095C Instructions for Forms 1094C and 1095C 15 Inst 1094C and 1095C Instructions for Forms 1094C and 1095C 14 Form 1095C EmployerProvided Health Insurance Offer and Coverage Form 1095C EmployerProvided Health Insurance Offer and CoverageIf filing on paper, the employer should send the forms to the IRS in a flat mailing package On each package, write the employer's name, number the packages consecutively, and place Form 1094C in package number one According to postal regulations, these forms must beForm 1094c instructions 21 Reap the benefits of a electronic solution to develop, edit and sign contracts in PDF or Word format on the web Transform them into templates for multiple use, incorporate fillable fields to collect recipients?

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Ez1095 Software How To Print Form 1095 C And 1094 C

Forms 1094C Federal instructions regarding Authoritative Transmittal are not applicable for California purposes Information on federal Form 1094C, line 19, is not required by the FTB When To File You will meet the requirement to file federal Forms 1094C and 1095C if the forms are properly addressed and mailed on or before the due date The IRS has released final Forms 1094/1095B (B Forms) and Forms 1094/1095C (C Forms), and related instructions, for the tax year As a reminder, the B Forms are filed by minimum essential coverage providers (mostly insurers and governmentsponsored programs, but also some selfinsuring employers and others) to report coverage information in accordance withData, put and request legallybinding digital signatures Get the job done from any gadget and share docs by email or fax

Ty Draft Forms 1095 C And 1094 C Released Along With New Form 1095 C Codes Press Posts

United Benefit Advisors Home News Article

# Publication 35B, California Instructions for Filing Federal Forms 1094B and 1095B # Publication 35C, California Instructions for Filing Federal Forms 1094C and 1095C Checkbox on Form 540/Form 540NR/Form 540 2EZ for fullyear health care coverage You will check the "Fullyear health care coverage"

Irs Form 1094 C Fill Out Printable Pdf Forms Online

2

Adp Com

Irs Releases Final Forms And Instructions For 17 Aca Reporting Brinson Compliance Brinson Benefits Employee Benefits Advisory And Patient Advocacy Firm

Aca Reporting For Individual Coverage Hras

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Irs Affordable Care Act Reporting Forms 1094 Ppt Download

17 01 11 12 59 1094 C 1095 C Reporting Youtube

Aca Employer Mandate And Reporting Rules When Acquiring A Non Ale Newfront Insurance And Financial Services

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

2

Irs Releases Draft 19 Aca Reporting Forms And Instructions Fedeli Group

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Irs Releases Aca Forms 1094 C And 1095 C Final Instructions

Draft 21 Aca Reporting Forms Issued By Irs The Aca Times

2

Cypress Benefit Administrators The Irs Has Released The Final 17 Instructions For Forms 1094 B 1095 B 1094 C And 1095 C To Help Employers Prepare For Calendar Year 17 Affordable Care Act Aca Information

18 Complyright 1094 C Transmittal Forms Pack Of 50 Vieforliving Com

Form 1094 C Instructions For Employers What You Need To Know

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

2

Draft 16 Instructions For Form 1094 C 1095 C Released Boomtax

Ins Employee 1095 C Report

16 Aca Reporting Forms And Instructions Revisions To Draft Forms 1094 C And 1095 C Eastern Insurance

The Instructions For Forms 1094 C And 1095 C Blog Taxbandits

Irs E Filing Deadline March 31 22 Aca Gps

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

1

1094 C 1095 C Software 599 1095 C Software

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

15 Forms 1094 B 1095 B 1094 C And 1095 C Benefits Work

Blog Irs 1094

1094 C Form Transmittal Zbp Forms

The Irs Releases Final 1094 C 1095 C Forms And Instructions For 18 Tax Year Foster Foster

Irs Form 1094 C Download Fillable Pdf Or Fill Online Transmittal Of Employer Provided Health Insurance Offer And Coverage Information Returns Templateroller

2

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Irs Releases Final Forms And Instructions For 18 Aca Reporting

Irs Releases Draft Instructions For Forms 1094 C And 1095 C Etc

3

An Introduction To The Irs Aca Reporting Forms For Employer Reporting

17 Draft Instructions For Forms 1094 C 1095 C Released

An Introduction To The Irs Aca Reporting Forms For Employer Reporting

Affordable Care Act Electronic Filing Instructions

Cdn2 Hubspot Net

Irs Releases Draft 19 Aca Reporting Forms And Instructions Sig

Updated Irs Reporting Requirements Babb Insurance

2

Final Aca Irs Forms 1094 C And 1095 C Released

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

Irs Finally Finalizes 19 Forms 1094 And 1095 And Related Instructions

Irs Releases Instructions And Draft Form 1094 C And 1095 C Basic

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

1094 C Reporting Requirements A Step By Step Guide

What Payroll Information Prints On Form 1094 C To The Irs

Health Reform Bulletin 132 Irs Releases Finalized 17 Forms And In

Aca Complyright 19 Aca Tax Software Use For Forms 1095 B And 1095 C And 1094 B And 1094 C Tax Forms Office Products

New Instructions For Forms 1094 C And 1095 C An Infographic The Aca Times

2

Irs Extends Deadline For Employers To Furnish Forms 1095 C And 1095 B Chicago Employee Benefits Byrne Byrne And Company

Mbwl Aca Prime Employer S Guide To Aca Reporting 1 9 17

Good Sense Guide To Minimum Essential Coverage Forms 1094 C And 1095 C

Instructions For Forms 1094 C And 1095 Cand Calcpa Health Trusted Health Plans For Cpas

2

Lockton Com

News Flash September 5 14 Irs Releases Draft Pay Or Play Informat

15 Form Irs 1094 C Fill Online Printable Fillable Blank Pdffiller

17 Form Irs 1094 C Fill Online Printable Fillable Blank Pdffiller

Irs Releases Draft 19 Aca Reporting Forms And Instructions Fedeli Group

Form 1095 C Instructions For Employers Furnishing Filing

Lawleyinsurance Com

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Irs Releases Draft 19 Aca Reporting Forms And Instructions Sequoia

Irs Releases Forms 1094 1095 And Related Instructions Including New Rules For Ichra Reporting

U S Affordable Care Act Aca Information Reporting 16 Sap Blogs

0 件のコメント:

コメントを投稿