4 Free Contractor Timesheet Templates Timesheets are data tables containing employee or contractor working hours for a particular periodCompanies use them to record work hours for attendance purposes, payroll, etc Note if you want to know more about contractor timesheets, skip ahead to this sectionYou can always scroll back here when done 1099 template Irs 18 Tax forms Best New 24 Fresh Image 1099 form Template Examples Make preparations for 13 Form 1099 filing Dye Whit b Tax and Picture Subcontractor Agreement Template Free Basic Subcontractor Agreement Simple Free Pay Stub Creator 1099 Template Word – crevis Sample Sample 1099 Tax Form New Grapher Resume Sample Beautiful Resume Download, 1099 Contract Employee Agreement Independent Contractor Agreement Form Template with Sample Free Independent Contractor Agreement Form Download Business Form Template Gallery 5 1099 Employee Contract Template Oiupt 1099 Employee Agreement form Employee Contract for 1099 1099 Employee Contract Template Independent Contractor

Truck Driver Independent Contractor Agreement Best Of 1099 Contractor Form What Is A Misc Form Financial Strategy Center Models Form Ideas

How to write a 1099 contract

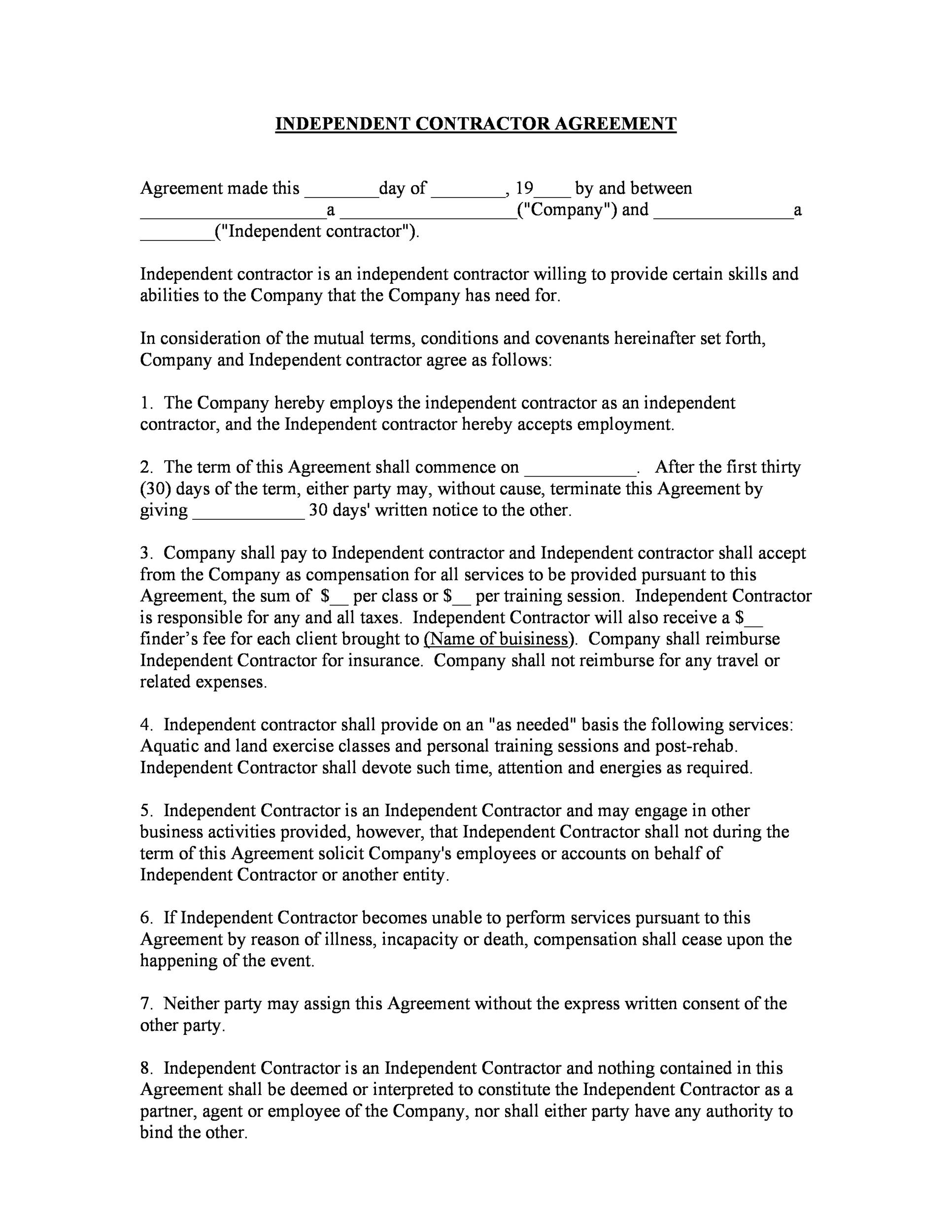

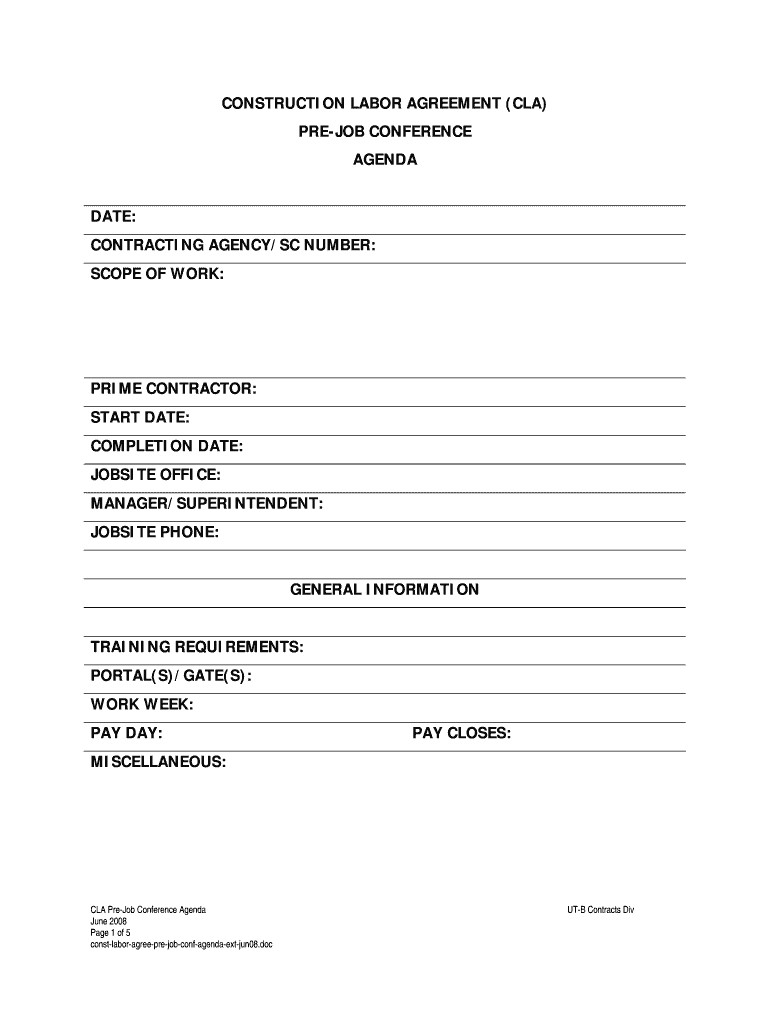

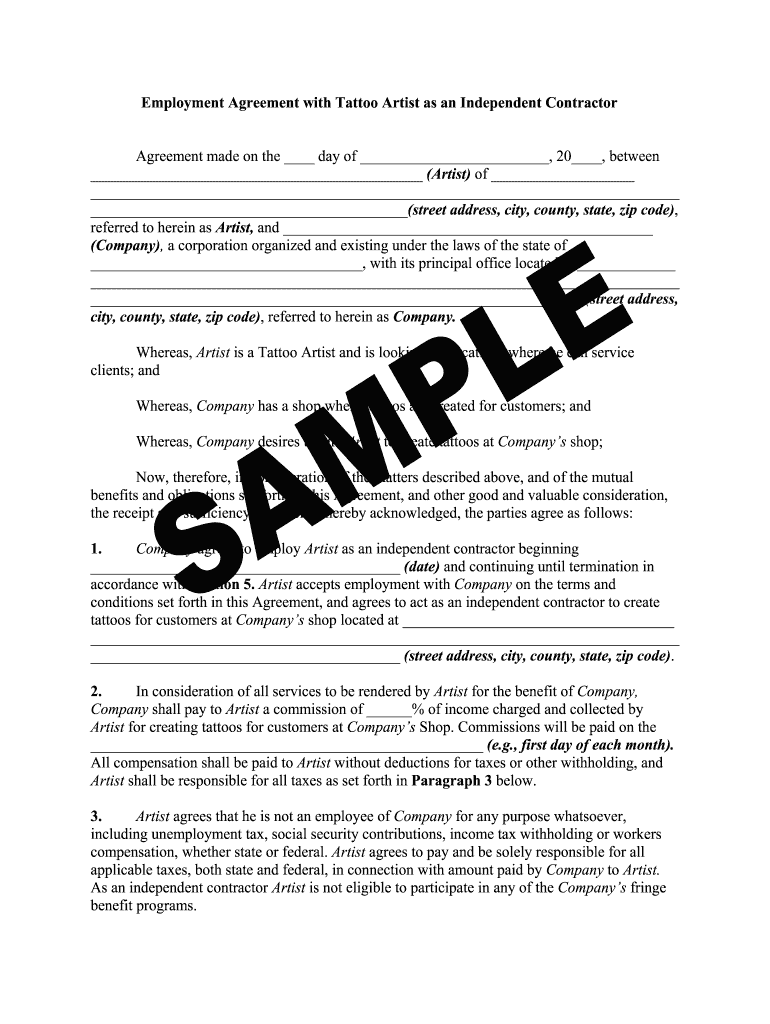

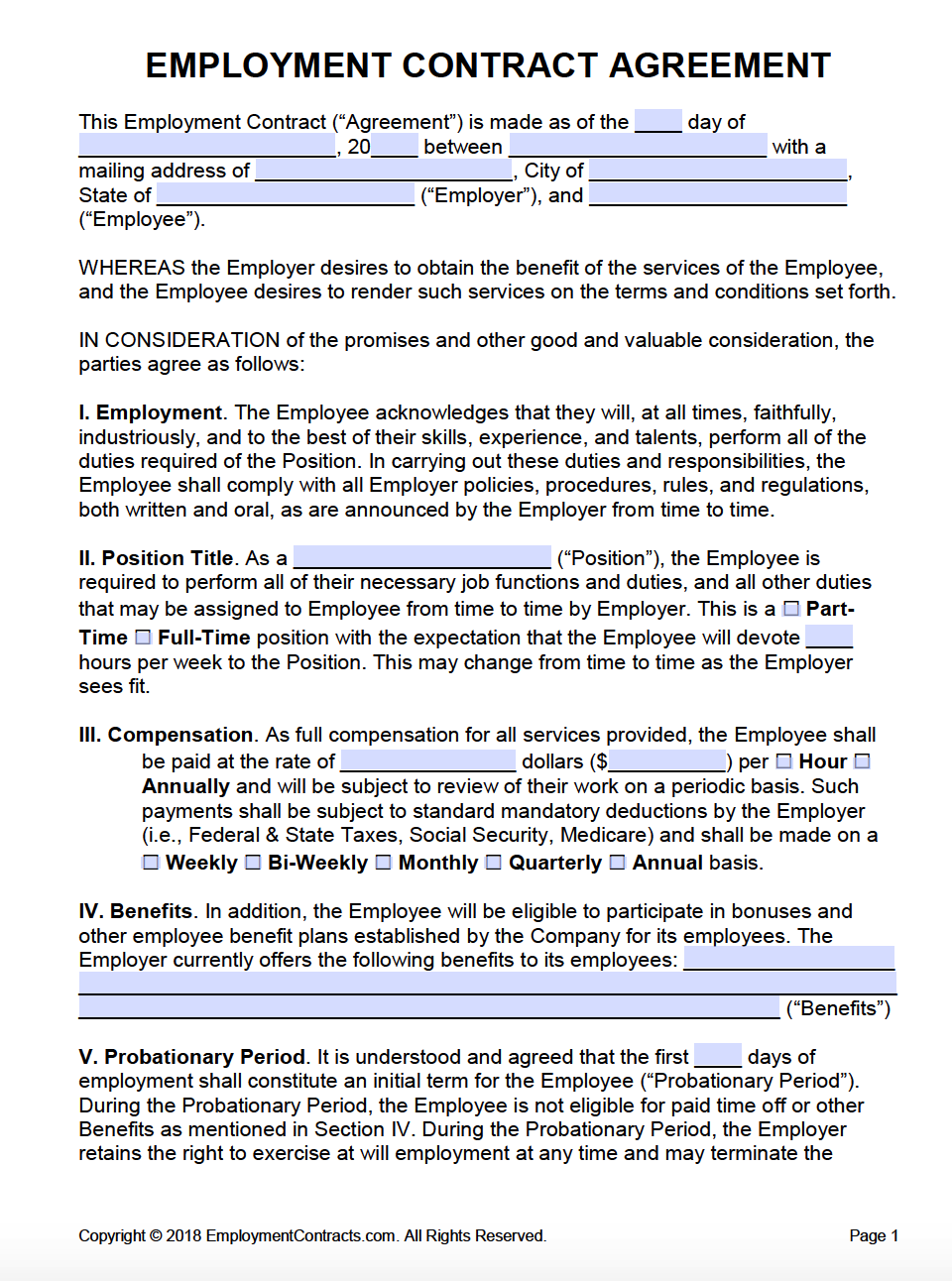

How to write a 1099 contract-The Employer hereby employs the Independent Contractor as an independent contractor, and the Independent Contractor hereby accepts employment 2 Start Date The term of this Agreement shall commence on _____, ____ Either party may, without cause, terminate this Agreement by giving ____ day(s') written notice to the other 3 A 1099 contractor is a person who works independently rather than for an employer There are significant differences in the legalities of a contractor and employee While the work can be similar in nature, it is important to follow the law with regard to

Http Www Mach4marketing Com Downloads Sales rep 1099 agreement Pdf

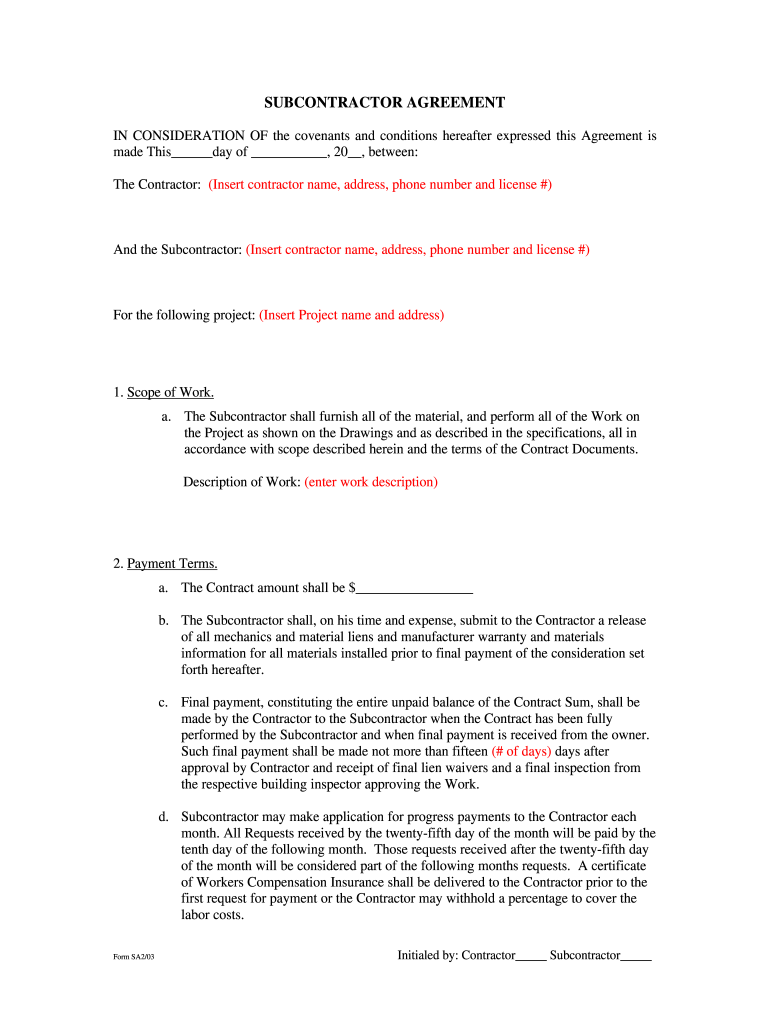

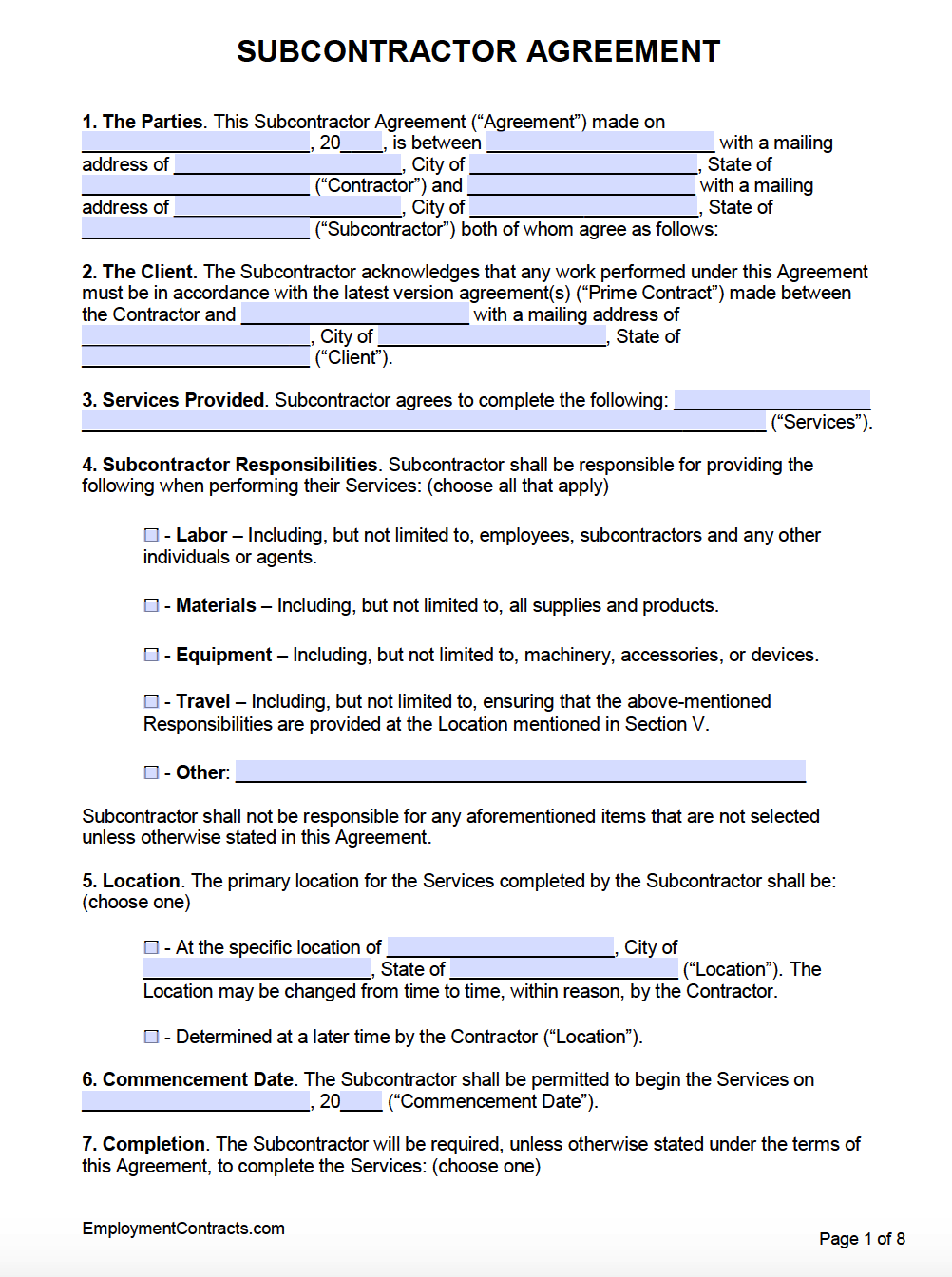

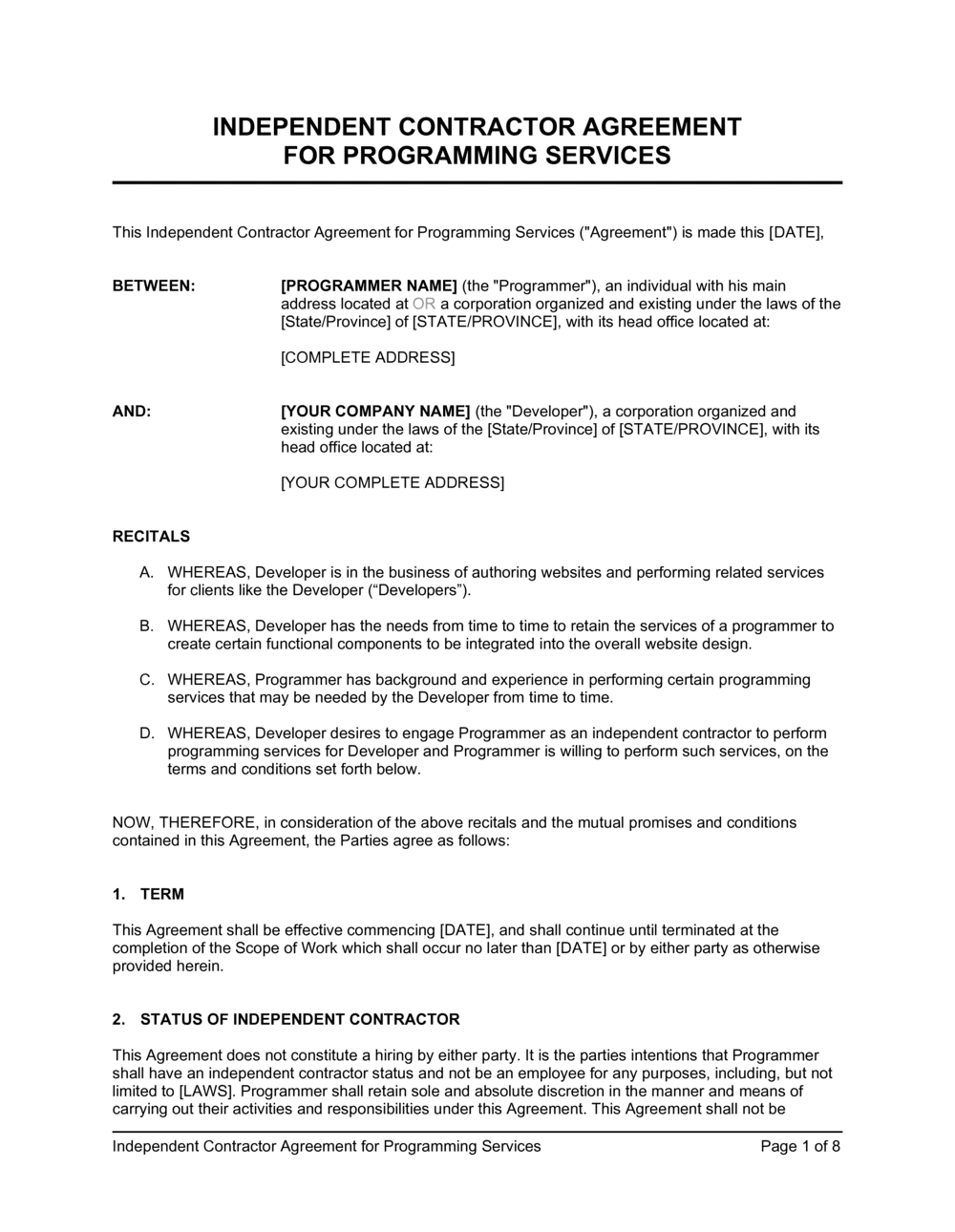

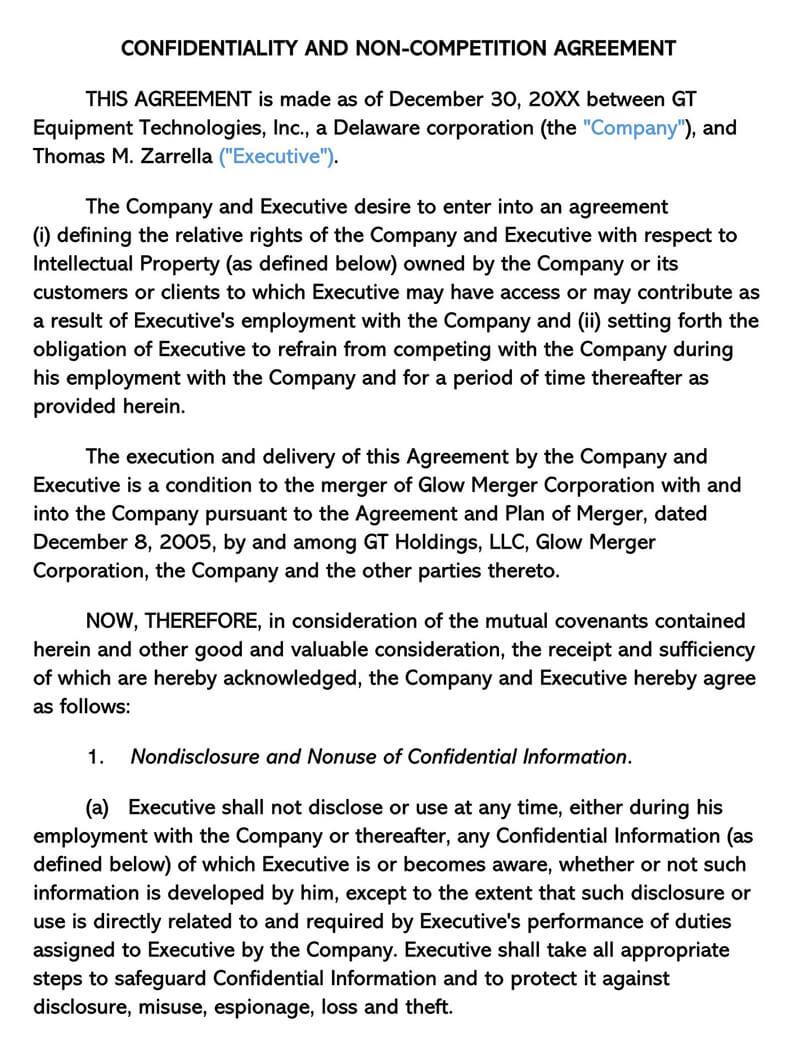

An Independent Contractor Agreement, also known as a consulting agreement or freelance contract Describes the services being provided or project to be completed Outlines payment details and the length, or term of the contract Sets out other terms of the working relationship, such as ownership of intellectual propertyForm 1099NEC as nonemployee compensation Any amount included in box 12 that is currently taxable is also included in this box This income is also subject to a substantial additional tax to be reported on Form 1040, 1040SR, or 1040NR See the Instructions for Forms 1040 and 1040SR, or the Instructions for 1099 Agreement Template Free Of Independent Contractor Agreement Template Sample free independent contractor agreement template & what to avoid an independent contractor agreement is a legal document between a business and an independent contractor that outlines the details of the work to be performed terms of the agreement deliverables pensation and any additional clauses free template and instructions provided free independent contractor agreement template

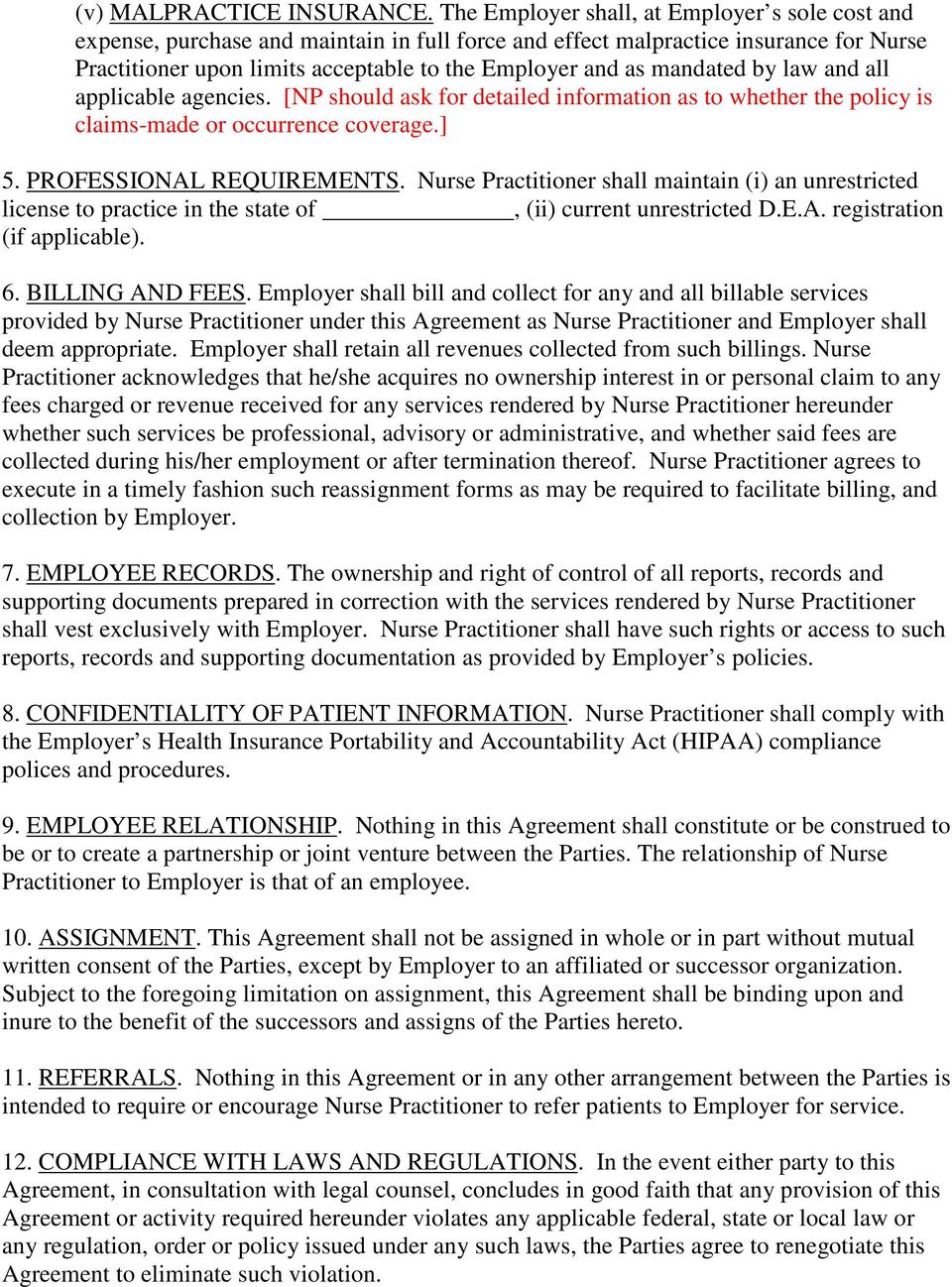

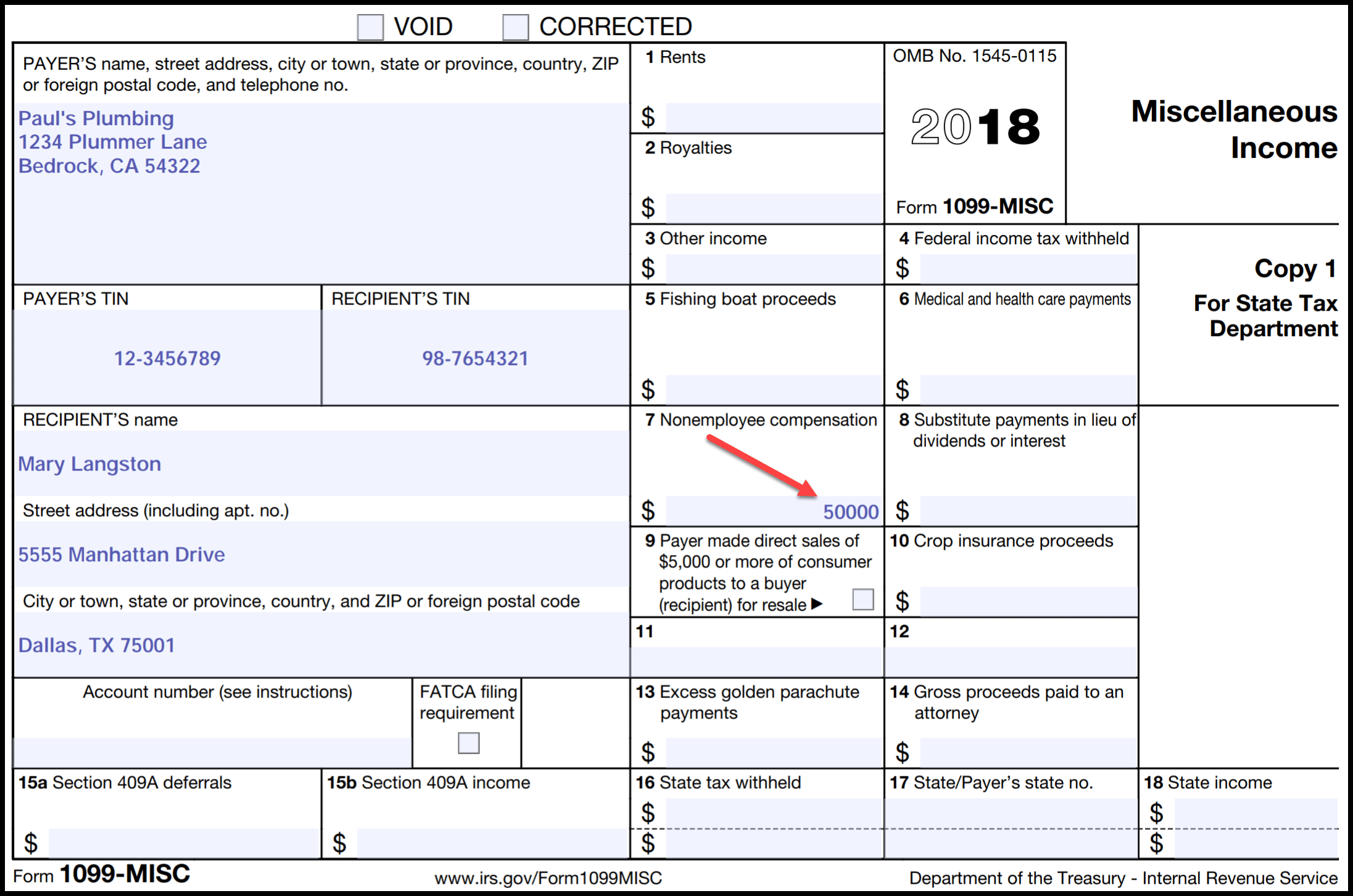

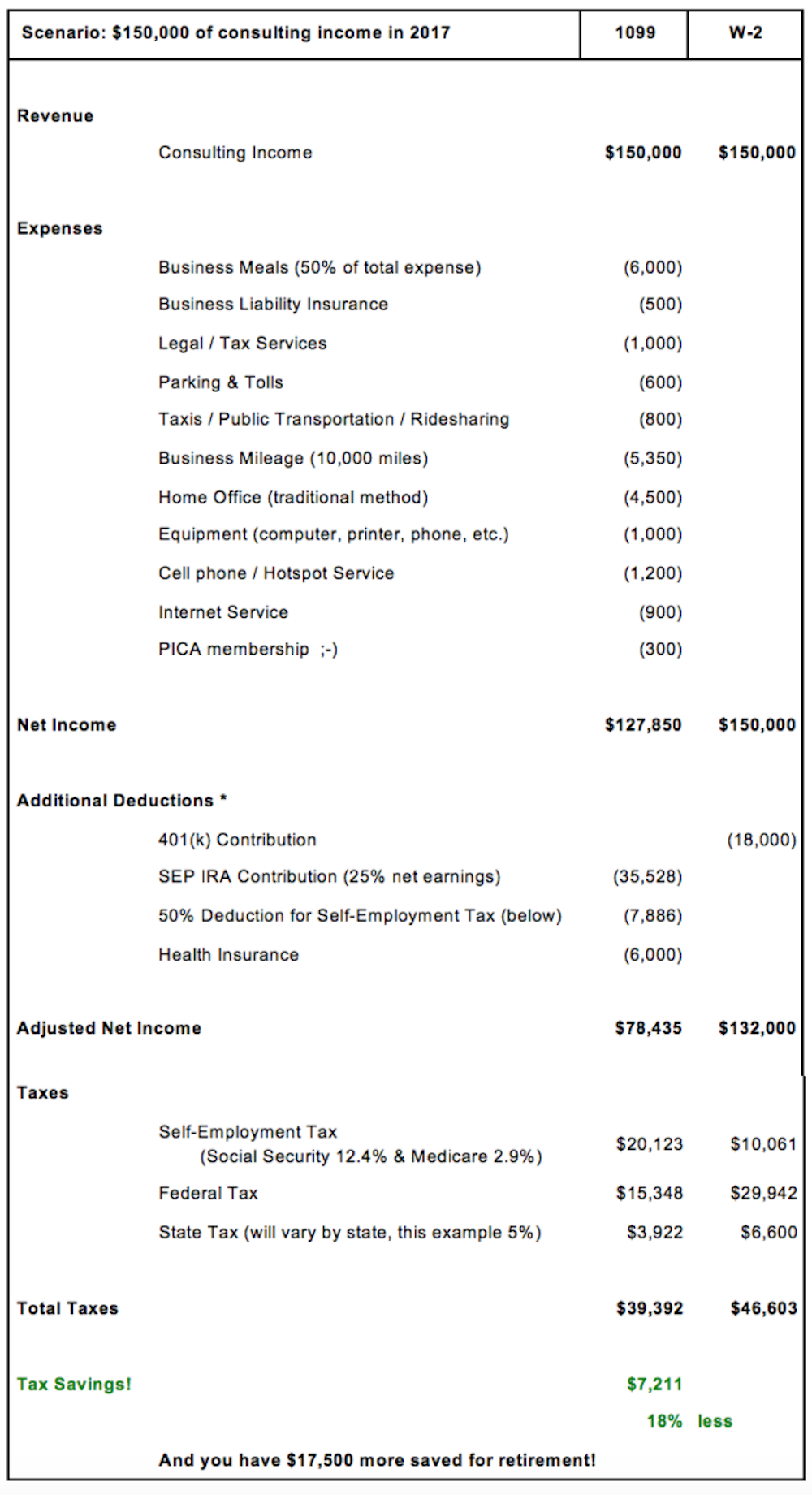

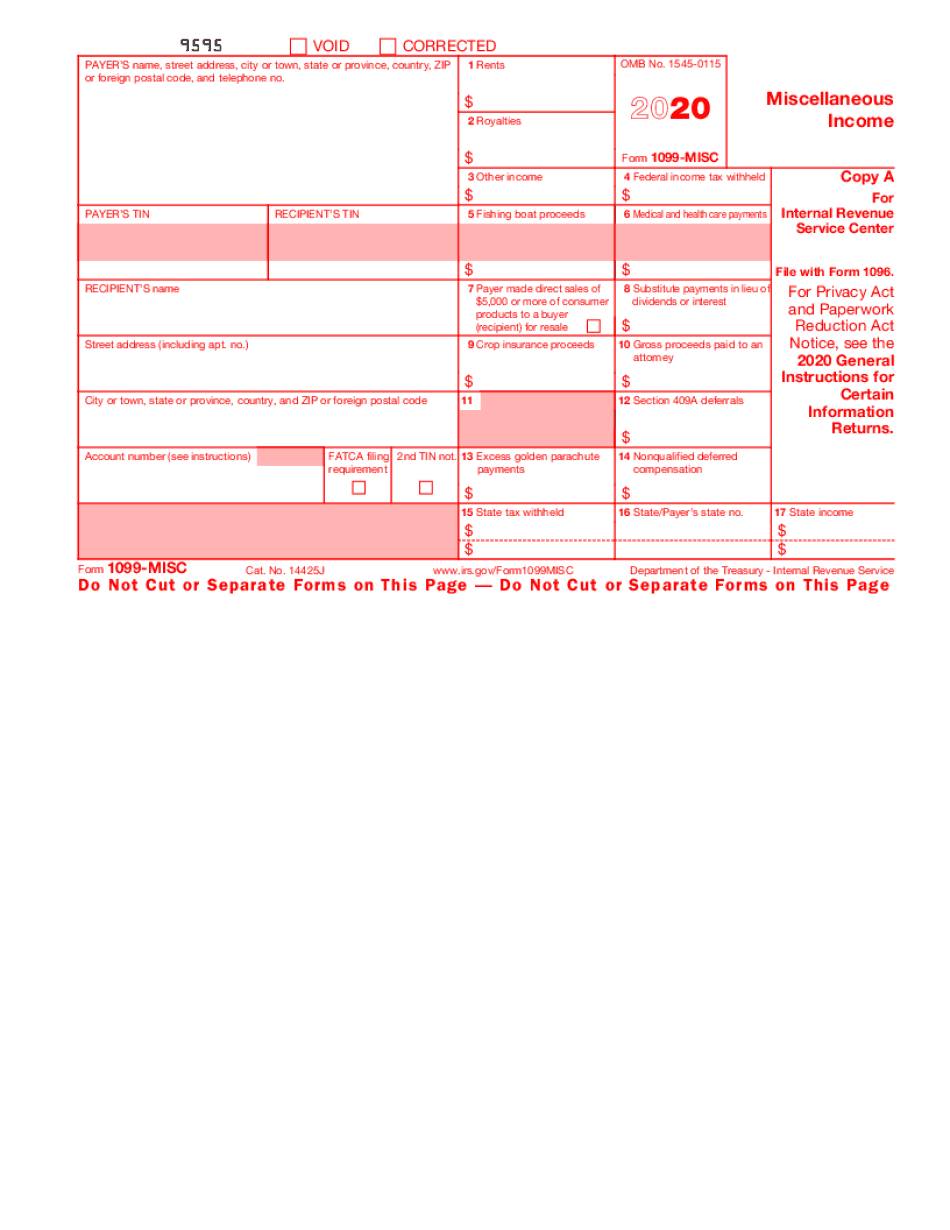

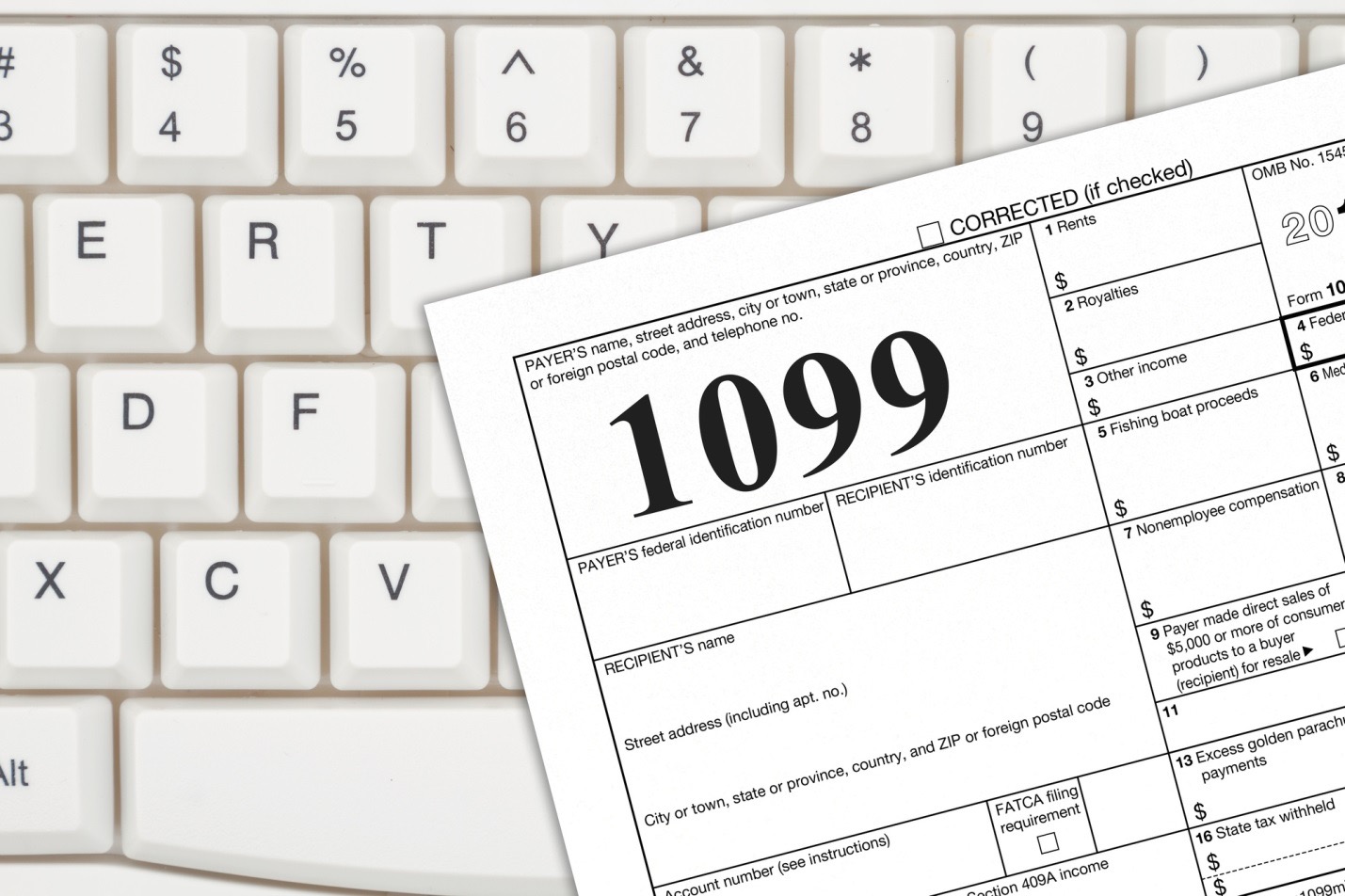

As well as your own health benefits, medical expenses, life insurance, and retirement fund CONTRACTOR also acknowledges that CONTRACTORAn independent contractor will be responsible for the payment of his own taxes, won't be eligible for any state or federal insurance, and is, most often, paid on a projecttoproject basis rather than on a recurring basis An independent contractor agreement, for tax purposes, is also known as a '1099' agreement Generally, the cash paid from a notional principal contract to an individual, partnership, or estate Payments to an attorney Any fishing boat proceeds In addition, use Form 1099MISC to report that you made direct sales of at least $5,000 of consumer products to a buyer for resale anywhere other than a permanent retail establishment

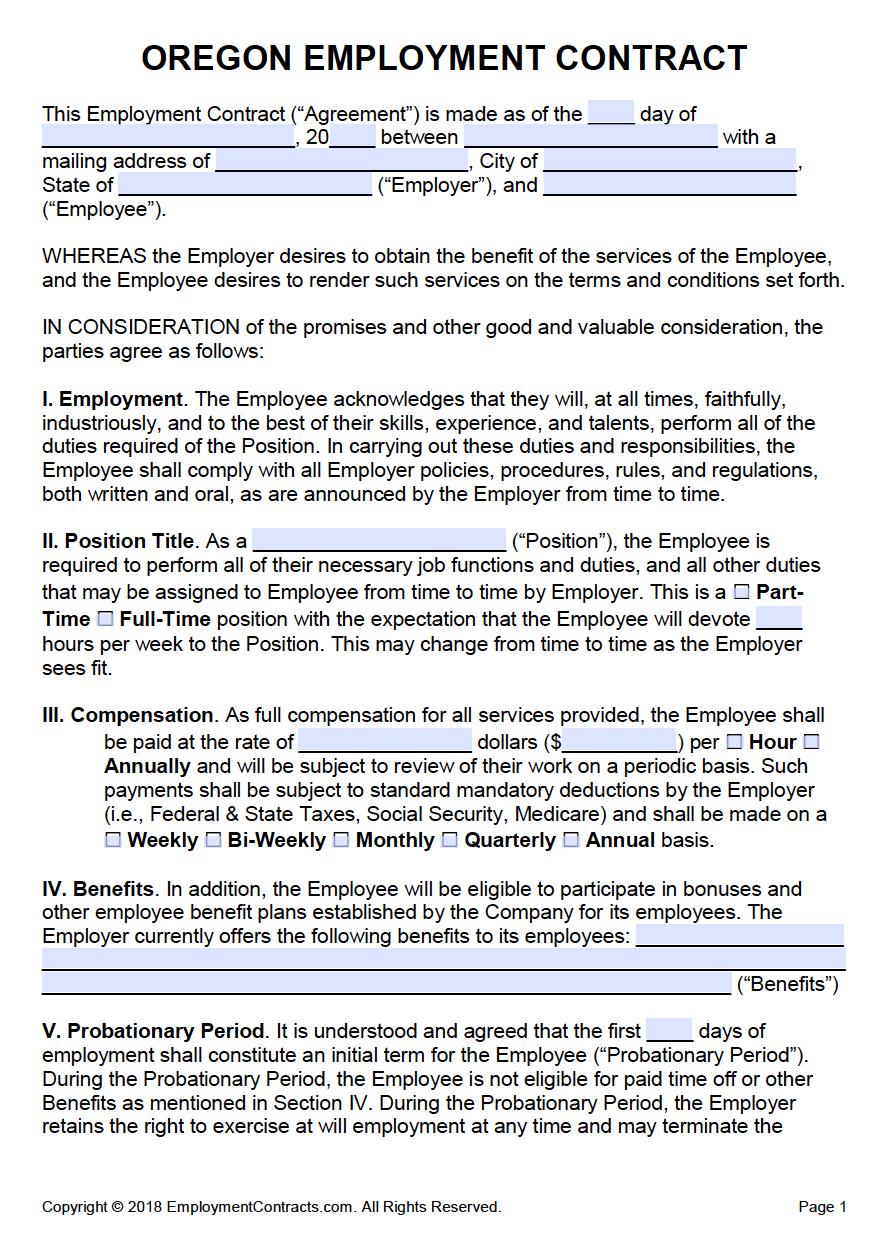

Employment contracts are between employers that hire and pay an employee, independent contractor, subcontractor, or freelancer The employment status depends on the IRS tax classification of the hired individual; 21 Posts Related to Free Pay Stub Template For 1099 Employee 1099 Employee 1099 Pay Stub Template Pdf Pay Stub Template For 1099 EmployeeContract RepHunter, Inc is not engaged in rendering legal services, and this Specimen Contract is provided only as an exemplar We strongly recommend that you consult with a qualified attorney before entering into any such agreements Independent Sales Representative Agreement THIS AGREEMENT is made as of the day of execution, between

Http Www Mach4marketing Com Downloads Sales rep 1099 agreement Pdf

Independent Contractor Template Contract For Va S The Legal Paige

If you're using a 1099 employee, you will first want to create a written contract If you pay them $600 or more over the course of a year, you will need to file a 1099MISC with the IRS and send a copy to your contractor If you need help with employee classification or filing the appropriate paperwork, post your need in UpCounsel's marketplaceAn Independent Contractor Agreement is a written contract that spells out the terms of the working arrangement between a contractor and client, including A description of the services provided Terms and length of the project or service Payment details (including deposits, retainers, and other billing details) 1099 In order to work as a 1099 contractor, the first step is to create a business that is not incorporated This business entity will not exist independently of you, so you don't need separate bank accounts If a 1099 contractor doesn't pay taxes, the IRS may go after the employer and hold the company liable for the tax requirement

How To Write An Independent Contractor Agreement Mbo Partners

Free Independent Contractor Agreement Template Download Wise

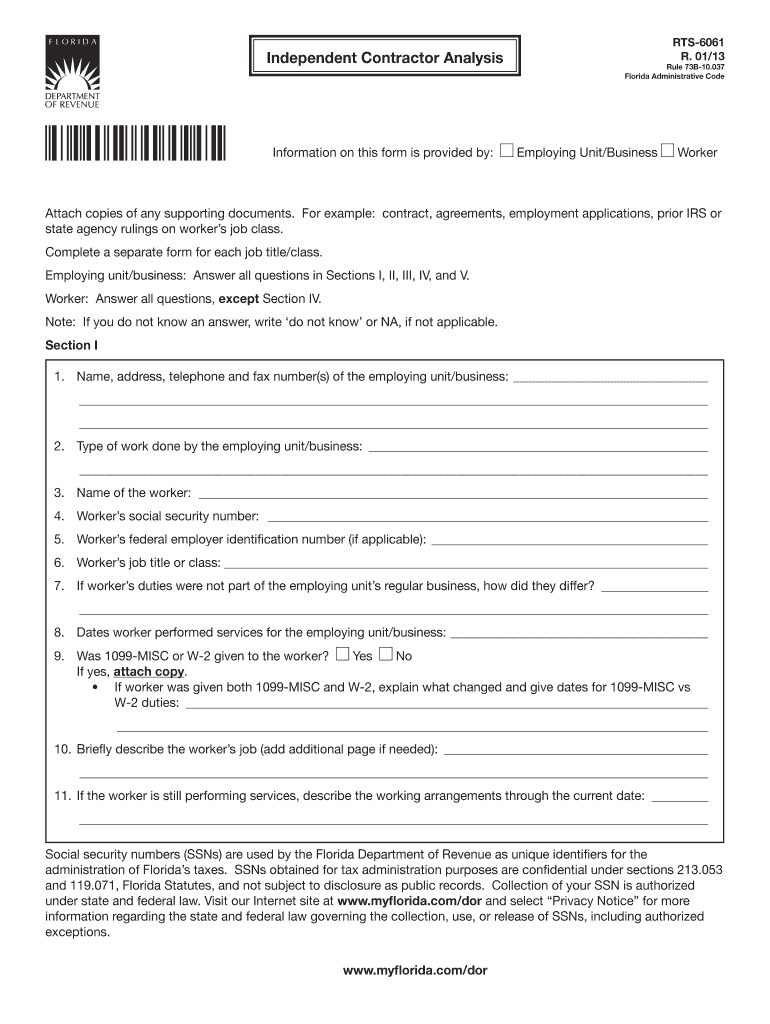

Issuing a 1099K depends on the number of transactions and the total dollar amount paid Use accounting software to fill out a Form 1099NEC for each contractor, and consult with a certified public accountant (CPA) regarding the 1099 forms your business must provide Completing Form 1099NEC Here is the information that must be provided on the1099 Contractor vs W‐2 Employee Contractors directed to a payroll service are often concerned that they will lose all their deductions, pay more taxes and take home less money Here are some facts that may help contractors in understanding what to expect when they are payrolled (W‐2), rather than engaged as an independent contractor (1099)SLS SAMPLE DOCUMENT 06/21/18 Independent Contractor Agreement Note This document does not reflect or constitute legal advice This is a sample made available by the Organizations and Transactions Clinic at Stanford Law School on the basis set out at nonprofitdocumentslawstanfordedu Your use of this document does not create an attorney

50 Free Independent Contractor Agreement Forms Templates

50 Free Independent Contractor Agreement Forms Templates

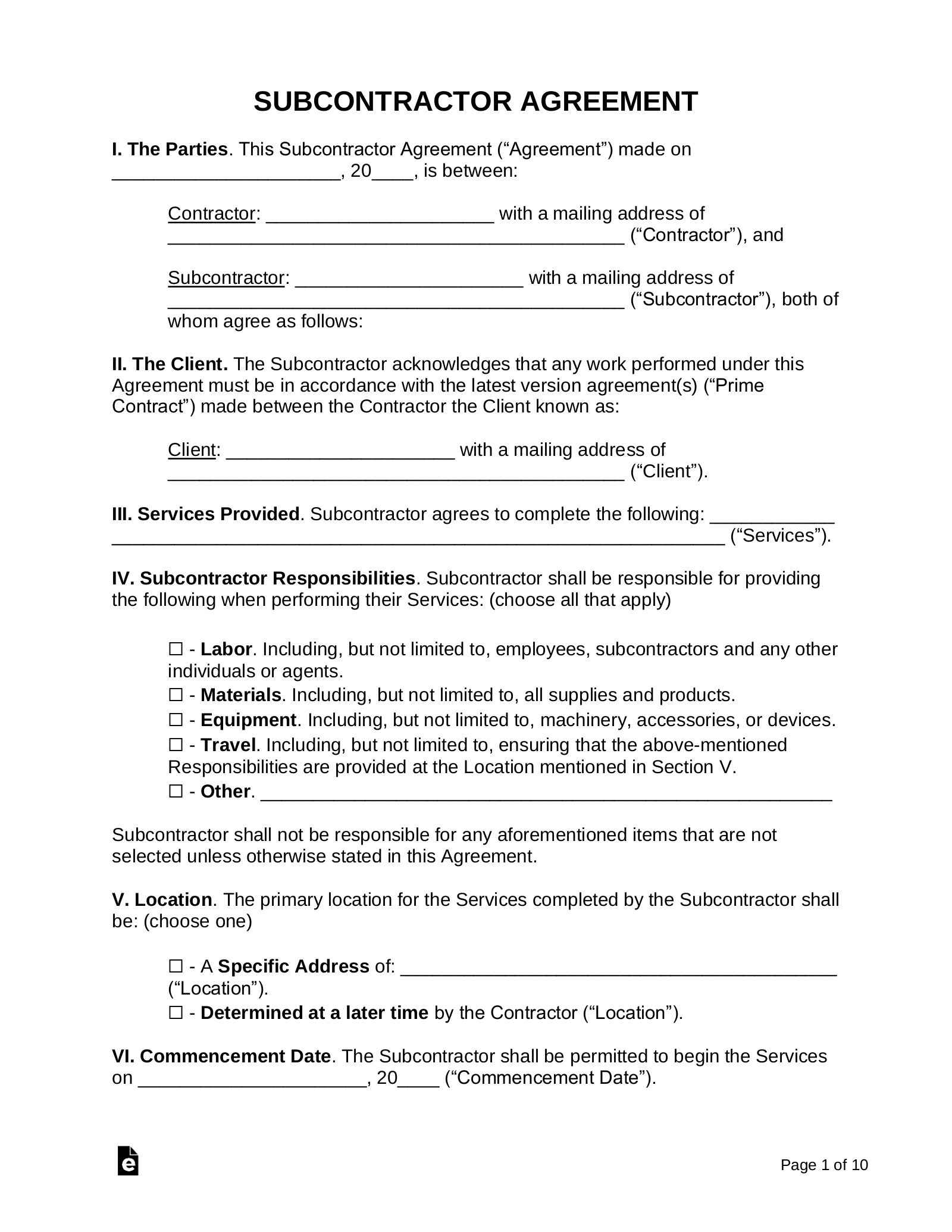

The Contractor may assign rights and may delegate duties under this Agreement to other individuals or entities acting as a subcontractor ("Subcontractor") The Contractor recognizes that they shall be liable for all work performed by the Subcontractor and shall hold the Client harmless of any liability in connection with their performed workMicrosoft Word Eastmark 1099 SubContractor AgreementDOC Author tmf Created Date• Issue Form 1099 MISC or W2 to workers you hire or employ As a booth renter, or independent contractor, you may need to make estimated tax payments during the year to cover your tax liabilities This is because as a booth renter (independent contractor), the business does not withhold taxes from your pay Estimated tax is the method used to

Galachoruses Org Sites Default Files Irs Questions W2 Vs 1099 Pdf

6 Bookkeeping Contract Templates Pdf Word Free Premium Templates

Independent contractor agreement template Use a independent contractor agreement template when working as an independent contractor for another business Set and clarify the terms of the job, and get paid into our smart new multicurrency business account Download template Open a business accountW2 (employee) or 1099 (independent contractor) Settlement for Unbiased (IRS Shape 1099) Contracting Products and services _____, known as CONTRACTING PARTY, and _____, known as INDEPENDENT CONTRACTOR, agree Click on right here for PDF model Because the tempo of Executive downsizing continues to extend, terminations for comfort–cancellations of contracts by means of the Executive just because its

Independent Contractor Contract Template Fill Online Printable Fillable Blank Pdffiller

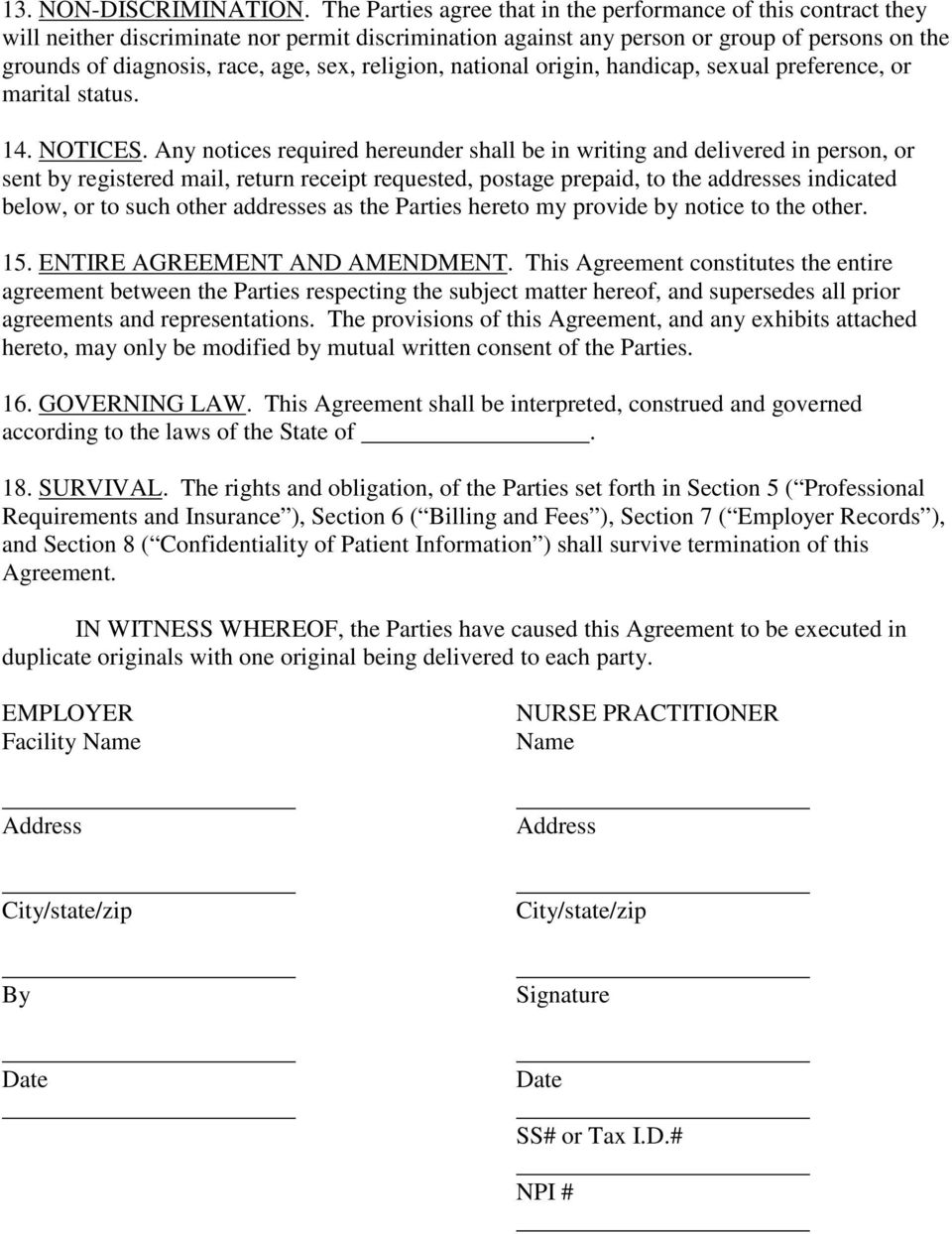

Nurse Practitioner Employment Contract Template For Primary Care Setting Pdf Free Download

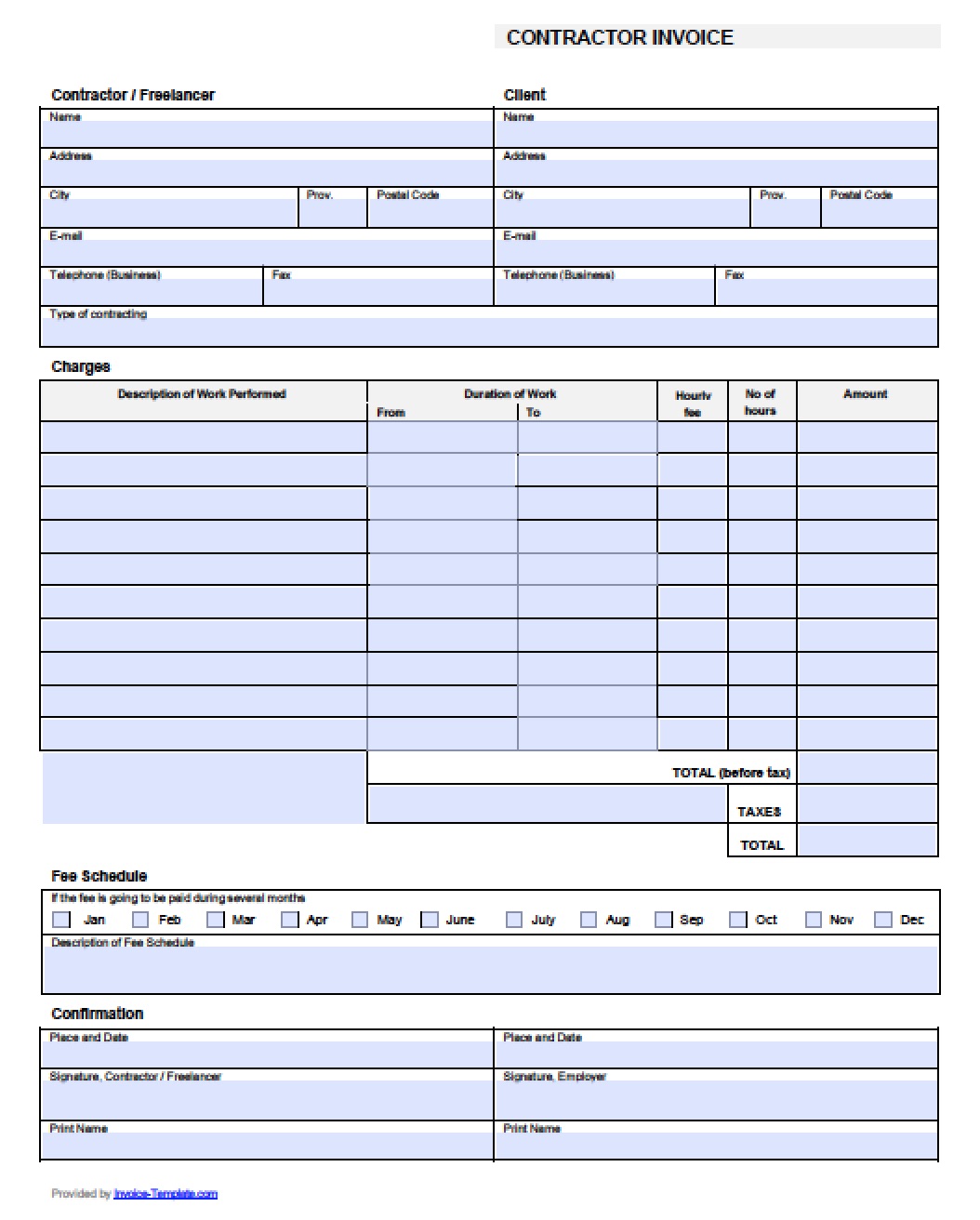

Independent Contractor (1099) Invoice Template The independent contractor invoice template allows an individual or company to bill a client for work provided In most cases, the invoice will include a combination of labor and materials used This invoice may be used for or any type of builder, painter, laborer, carpenter, electrician, equipment operator, or any type of work related When you terminate a sales representative, you need to calculate a final commission report and you must remember to complete the IRS Form 1099 at the end of the year for that salesperson You can create your own nonexclusive sales representative agreement or you can work with an attorney or use a nonexclusive sales agreement template to do so You are wise to get this agreement signed with independent contractors to protect your interests in any IRS audit It serves to document the provider's role as a 1099 contractor as opposed to being an employee 1 Make multiple copies Put one in the file kept for the individual service provider and another in your accounting files

Free Independent Contractor Agreement Templates Pdf Word Eforms

50 Free Independent Contractor Agreement Forms Templates

If you're unsure, refer to the IRS definition of a contractor Independent contractor relationships are best managed with a contract Additionally, don't give your 1099 contractors a copy of your employee handbook, because you never want to muddy the line between contract and employee labor1099 Employee Contract Ready to hire someone to help with your business but not ready for them to be an Employee? A 1099 sales rep agreement is important to have for companies that employ sales representatives It can be the difference between staying open and being forced to shut down the company Employees who only get commissions are called 1099ers due to the 1099MISC form that they receive every year This is different from the W2 forms that salaried

I Forgot To Send My Contractors A 1099 Misc Now What

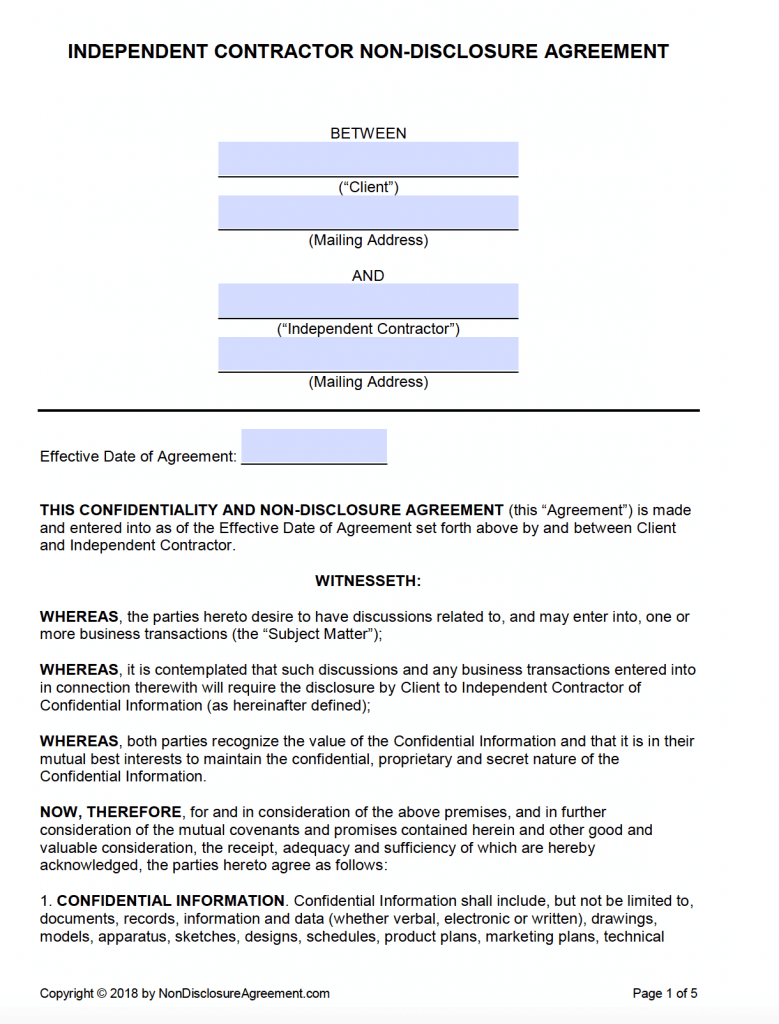

Free Independent Contractor Non Disclosure Agreement Nda Pdf Word Docx

An independent contractor agreement is between a client and a company that makes a promise to produce services in exchange for payment The client will have no responsibility for employees, subcontractors, or personnel in connection with the services provided Their only obligation will be to pay the independent contractor with no liability if anyone should get injuredPayer is reporting on this Form 1099 to satisfy its account reporting requirement under chapter 4 of the Internal Revenue Code You may also have a filing requirement See the Instructions for Form 38 Amounts shown may be subject to selfemployment (SE) tax Individuals should see the Instructions for Schedule SE (Form 1040) Corporations,50 FREE Independent Contractor Agreement Forms & Templates Provided that the relationship and scope of work between them and the company is clearly outlined before the commencement of a project, independent contractors can help a company to save money on employment taxes A great way for independent contractors to outline the relationship and

1099 Contract Employee Agreement

Sample Independent Contractor Non Compete Agreement Word Pdf

Download the independent contractor invoice template to formally request payment for most any type of independent contracting work This includes freelance home repair, graphic design, writing, and much more Be sure to accurately describe the work you performed and the charges being applied IRS 1099MISC Form – Filed by an independent contractor at the end of the year if theyYou need to hire an Independent Contractor (they work for you but you are not responsible for any tax withholdings and or insurance )This Independent Contractor Contract Template allows for peace of mind between the primary and secondary individuals in a business contractualThe Texas Independent Contractor Agreement is a contract entered into by two parties, the client and the independent contractor The document specifies the service to be performed by the contractor, the compensation for the service, and the date

Employment Contract Template Fill Online Printable Fillable Blank Pdffiller

Free Notice Of Contract Termination Free To Print Save Download

Professional Services Agreement For 1099 Representative Start Date _____ This AGREEMENT made and entered into by and between Mach4Marketing, having an address of Dayton Ln, Temecula, CA (hereinafter "COMPANY"), and _____, having an address ofThe 1099MISC is how they report income on their individual income tax return You are required to do this if you pay them more than $600 within a year To satisfy your IRS obligation, you'll have to send the completed 1099 Form to the IRS and the contract worker1 Definition CONTRACTOR is responsible for own taxes through a 1099 tax form at the end of every filing year;

1099 Misc Form Fillable Printable Download Free Instructions

Subcontractor Agreement Construction Fill Online Printable Fillable Blank Pdffiller

To make tracking Schedule C expenses easier, the best option is to use a 1099 template (Schedule C template) Most of the time, this will be an excel template because it is the simplest to use and easiest to customize based on your specific business Is a Free or Paid Excel Template Better?Client will not require Contractor to rent or purchase any equipment, product, or service as a condition of entering into this Agreement 5 Independent Contractor Status Contractor is an independent contractor, and neither Contractor nor Contractor's employees or contract personnel are, or shall be deemed, Client's employeesIndependent Contractor Pay Stub Templates 123PayStubs offers a variety of professional 1099 pay stub templates for both the employees and contractors in different styles and designs You can choose from any pay stub samples to generate a pay stub for your 1099 contractors And the best part is all the paystub templates are free

Free Sales Representative Contract Free To Print Save Download

Www Brotherhoodmutual Com Resources Safety Library Risk Management Forms Independent Contractor Sample Agreement

Using an independent contractor agreement template will save you time over creating an agreement from scratch If you hire an independent contractor, you will be required to fill out a Form 1099NEC if you pay them more than $600 within a year The 1099NEC is needed to report how much income an independent contractor earns in a year 22 1099 form Independent Contractor Free from 1099 agreement template free , sourceandroidtospaincomThe independent contractor nondisclosure agreement is intended for use with workers (sometimes known as "1099 contractors" because of their tax status) who perform tasks for you or your business Unlike employees, independent contractors are not bound to maintain secrecy under most state laws That is, if you disclose a trade secret to a contractor without a nondisclosure agreement

Independent Contractor 1099 Invoice Templates Pdf Word Excel

Independent Contractor Contract Template The Contract Shop

Free Professional Marketing Agreement Template For Download

1099 Misc Form Fillable Printable Download Free Instructions

Independent Contractor Invoice Template Free Beautiful 7 Independent Contractor Invoice Invoice Template Estimate Template Excel Budget Template

New Truck Driver Independent Contractor Agreement Models Form Ideas

Free One 1 Page Independent Contractor Agreement Pdf Word Eforms

Download 1099 Forms For Independent Contractors Fresh Free Contractor Agreement Template New Create A New Check For Vendor Models Form Ideas

Employee Versus Independent Contractor The Cpa Journal

Independent Contractor Contract Template The Contract Shop

What If A Contractor Or Vendor Refuses To Provide A W 9 For A 1099 Politte Law Offices Llc

Hiring Independent Contractors Vs Full Time Employees Pilot Blog

Nurse Practitioner Employment Contract Template For Primary Care Setting Pdf Free Download

Hiring Guide For 1099 Independent Contractors Legalities Forms Taxes Exaktime

Free Oregon Employment Contract Template Pdf Word

Contractor Invoice Templates Free Download Invoice Simple

Www Thefitmill Com Uploads 5 1 2 3 Tfm Icagreement June15 Pdf

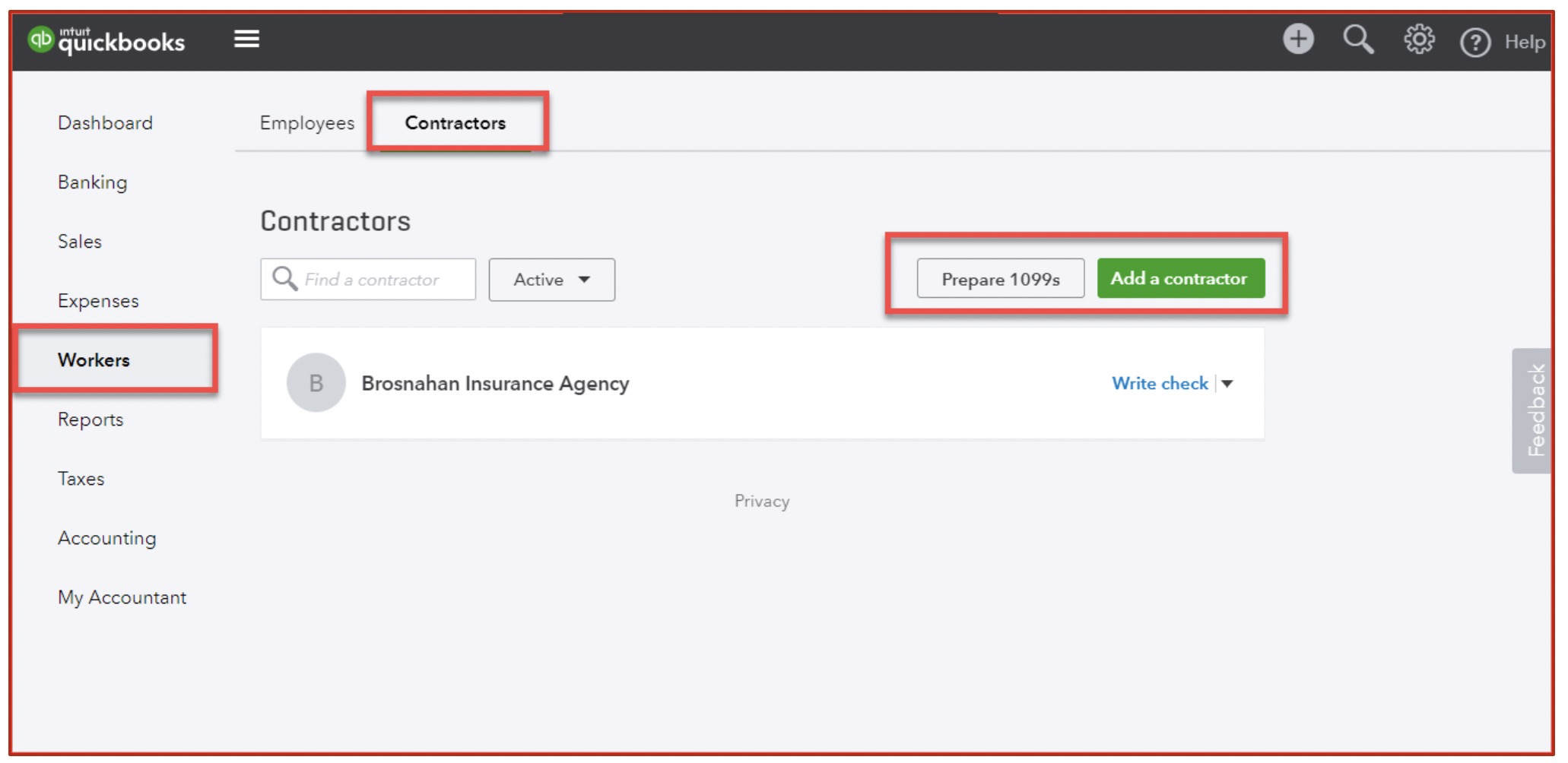

Quickbooks 1099 Guide Sending 1099s Adding Contractors More

Independent Contractor Taxes Guide 21

/documents-when-hiring-a-contract-worker-398608_final-c7b9e3e0f1704d388f723fe60239b079.png)

3 Documents You Need When Hiring A Contract Worker

Independent Contractor 1099 Invoice Templates Pdf Word Excel

F 1099 Misc

50 Free Independent Contractor Agreement Forms Templates

Truck Driver Independent Contractor Agreement Best Of 1099 Contractor Form What Is A Misc Form Financial Strategy Center Models Form Ideas

Why You Need To Understand The Difference Between Independent Contractor Self Employed And Employee Nurse Practitioners In Business

1099 Form Independent Contractor Agreement Unique 1099 Form Independent Contractor Agreement Example Forms For Models Form Ideas

Free Subcontractor Agreement Template Pdf Word

Free Independent Contractor Agreement Pdf Word

Independent Contractor 1099 Invoice Templates Pdf Word Excel

1

Free Subcontractor Agreement Free To Print Save Download

3

What Forms Do You Need To Hire An Independent Contractor Workest

Independent Contractor Agreement For Programming Services Template By Business In A Box

1099 Workers Vs W 2 Employees In California A Legal Guide 21

1099 Vs W2 Pica Pica

Independent Contractor 1099 Invoice Templates Pdf Word Excel

Free Trucking Contract Free To Print Save Download

Independent Contractor Agreement Template Contract The Legal Paige

1099 Form Printable And Fillable Pdf Template

1

Www Hws Edu Offices Pdf Independent Contractor Agreement2 Pdf

Irs Form 1099 Misc Download Fillable Pdf Or Fill Online Miscellaneous Income Templateroller

Download 1099 Forms For Independent Contractors Unique Independent Sales Agent Contract Fresh 1099 Contractor Agreement Models Form Ideas

Free Non Compete Agreement Templates Employee Contractor

Free Independent Contractor Agreement Templates Word Pdf

Free General Contractor Invoice Template Pdf Word Excel

Physician S Guide To Independent Contractor Agreements

Blank Contractor Agreement Fill Online Printable Fillable Blank Pdffiller

Free Subcontractor Agreement Templates Pdf Word Eforms

W9 Vs 1099 A Simple Guide To Contractor Tax Forms Bench Accounting

Property Management Contract Template 2 Free Templates In Pdf Word Excel Download

Free Professional Marketing Agreement Template For Download

Independent Contractor Agreement Business Taxuni

Free California Independent Contractor Agreement Word Pdf Eforms

Capclaw Com Wp Content Uploads 13 11 Consulting Agreement Template For 1099 Ee Pdf

Newportbeachca Gov Home Showdocument Id

3

Independent Contractor Invoice Template Excel Lovely Independent Contractor Invoice Template Invoice Template Word Invoice Template Template Design

Employee Vs Independent Contractor Groomer To Groomer

Free Independent Contractor Agreement Template Download Wise

Free Contractor Invoice Template Independent Contractor Invoice Bonsai

What Is Form 1099 Misc When Do I Need To File A 1099 Misc Gusto

New Truck Driver Independent Contractor Agreement Models Form Ideas

Free Printable Employment Agreement Actors Form Generic

Tattoo Shop Artist Agreement Fill Online Printable Fillable Blank Pdffiller

50 Free Independent Contractor Agreement Forms Templates

Newportbeachca Gov Home Showdocument Id

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

Fl Rts 6061 13 Fill Out Tax Template Online Us Legal Forms

50 Editable Contract Termination Letters Free Templatearchive

Tax Deductions For Independent Contractors Kiplinger

Independent Contractor Profit And Loss Statement The Spreadsheet Page

Form 1099 Nec Form Pros

Free Employment Agreements Contracts Pdf Word

What Is The Difference Between A W2 Employee And A 1099 Employee Az Big Media

Instant Form 1099 Generator Create 1099 Easily Form Pros

Newportbeachca Gov Home Showdocument Id

Independent Contractor 1099 Invoice Templates Pdf Word Excel

1099 Invoice Template Beautiful Independent Contractor 1099 Invoice Template Invoice Template Invoicing Create Invoice

Independent Contractor Agreement Free Contractor Templates 360 Legal Forms

0 件のコメント:

コメントを投稿